If I Sell My Car for Cash Do I Have to Pay Taxes

If you sell your car for cash, you generally don’t have to pay taxes—unless you’re running a business or selling multiple vehicles. Personal vehicle sales are typically tax-free if you sell it for less than you paid. However, there are exceptions, so it’s important to understand the IRS rules to avoid surprises.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Selling Your Car for Cash—What You Need to Know

- 4 Are Personal Car Sales Taxable? The Short Answer

- 5 Business Use Vehicles: A Different Tax Story

- 6 Cash Sales and IRS Reporting: What You Need to Know

- 7 State Tax Rules: Don’t Forget Local Laws

- 8 Real-Life Examples: How Taxes Apply in Practice

- 9 Conclusion: Stay Informed, Stay Compliant

- 10 Frequently Asked Questions

- 10.1 Do I have to pay taxes if I sell my car for cash?

- 10.2 What if I sell my car for more than I bought it for?

- 10.3 Do I need to report a cash car sale to the IRS?

- 10.4 Will I get a 1099 form when I sell my car for cash?

- 10.5 What records should I keep after selling my car?

- 10.6 Can I sell my car to a family member without paying taxes?

Key Takeaways

- Personal car sales are usually tax-free: If you sell your personal vehicle for cash and don’t make a profit, you likely won’t owe any taxes.

- Profit from sale may be taxable: If you sell your car for more than its original purchase price (adjusted for depreciation), the gain could be considered taxable income.

- Business-related vehicle sales are different: If you sell a car used for business purposes, especially if it was depreciated, you may owe taxes on the gain.

- No 1099-K form for most private sales: The IRS doesn’t require payment platforms to report private car sales under $600, so cash deals often fly under the radar—but you’re still responsible for reporting gains.

- Keep records of the sale: Save the bill of sale, title transfer, and purchase receipts to prove your cost basis and avoid issues if audited.

- State rules may vary: While federal tax rules are consistent, some states have additional reporting requirements or sales tax implications.

- Don’t confuse sales tax with income tax: Sales tax is paid by the buyer when registering the car, not by the seller as income tax.

📑 Table of Contents

- Introduction: Selling Your Car for Cash—What You Need to Know

- Are Personal Car Sales Taxable? The Short Answer

- Business Use Vehicles: A Different Tax Story

- Cash Sales and IRS Reporting: What You Need to Know

- State Tax Rules: Don’t Forget Local Laws

- Real-Life Examples: How Taxes Apply in Practice

- Conclusion: Stay Informed, Stay Compliant

Introduction: Selling Your Car for Cash—What You Need to Know

So, you’ve decided to sell your car for cash. Maybe you’ve outgrown it, need the money, or just want something newer. Whatever the reason, selling a car can feel like a big step—especially when money changes hands. And naturally, one of the first questions that pops into your head is: “Do I have to pay taxes on this?”

It’s a smart question. Taxes touch almost every financial transaction, so it’s only natural to wonder if your cash windfall from selling your car counts as taxable income. The good news? In most cases, selling your personal vehicle for cash won’t trigger a tax bill. But—and this is a big but—there are exceptions. Whether you owe taxes depends on several factors, including how much you sell it for, why you’re selling it, and how the car was used.

Let’s break it down in simple terms. This guide will walk you through everything you need to know about taxes when selling your car for cash. We’ll cover federal rules, state considerations, record-keeping tips, and real-life examples to help you stay on the right side of the law—without overpaying.

Are Personal Car Sales Taxable? The Short Answer

Visual guide about If I Sell My Car for Cash Do I Have to Pay Taxes

Image source: zippycarcash.com

The short answer is: usually not. If you’re selling your personal car—the one you drive to work, take the kids to school, or use for weekend trips—and you sell it for cash, you typically don’t have to pay income taxes on the sale. Why? Because the IRS doesn’t treat personal asset sales like regular income unless you make a profit.

Here’s how it works: When you buy a car, it starts losing value the moment you drive it off the lot. That’s called depreciation. Over time, your car becomes worth less than what you paid for it. So, if you sell it later for less than your original purchase price (your “cost basis”), you’re not making money—you’re losing it. And the IRS doesn’t tax losses on personal items.

For example, let’s say you bought a used sedan for $15,000 two years ago. Now, it’s worth about $10,000. If you sell it for $9,500 in cash, you’re actually losing $5,500. That’s a personal loss, not income. So, no taxes are due.

But what if you sell it for more than you paid? That’s where things get interesting—and potentially taxable.

When a Personal Car Sale Could Be Taxable

While rare, it is possible to sell a personal car for a profit. This usually happens with classic cars, rare models, or vehicles that have appreciated in value over time. For instance, if you bought a vintage Mustang for $20,000 and sold it five years later for $35,000, you’ve made a $15,000 gain.

In this case, the IRS may consider that gain taxable. However, there’s a catch: the tax treatment depends on how the car was used. If it was strictly a personal vehicle—not used for business or investment—the gain might still be exempt under certain conditions.

The IRS allows you to exclude up to $250,000 in gain ($500,000 for married couples) from the sale of a primary residence, but there’s no similar exclusion for cars. However, because personal vehicles are considered “personal use property,” any gain is typically treated as a capital gain—and capital gains on personal items are only taxed if they exceed certain thresholds or are part of a pattern of sales.

But here’s the reality: the IRS rarely goes after small gains from personal car sales. If you sell your daily driver for a few thousand dollars more than you paid, it’s unlikely to raise red flags. Still, it’s important to know the rules.

Business Use Vehicles: A Different Tax Story

Visual guide about If I Sell My Car for Cash Do I Have to Pay Taxes

Image source: i.imgur.com

Now, let’s talk about business vehicles. If you used your car for work—say, as a rideshare driver, delivery person, or contractor—the tax rules change significantly. In this case, the car isn’t just a personal asset; it’s a business tool. And when you sell a business asset, the IRS pays close attention.

Depreciation and Recapture

When you use a car for business, you can often deduct a portion of its cost each year through depreciation. This reduces your taxable income over time. But here’s the kicker: if you later sell the car for more than its depreciated value, the IRS may require you to “recapture” some of those depreciation deductions as taxable income.

For example, suppose you bought a van for $30,000 and used it 100% for your landscaping business. Over three years, you claimed $18,000 in depreciation. That means the car’s adjusted basis is now $12,000. If you sell it for $20,000, you’ve made an $8,000 gain. The IRS will treat that $8,000 as taxable income—part of it may be ordinary income (from recaptured depreciation), and part may be capital gain.

This is why business owners need to be extra careful when selling vehicles. The tax implications can be complex, and mistakes can lead to penalties.

Selling Multiple Cars? You Might Be Running a Business

Another red flag for the IRS is selling multiple cars in a short period. If you’re regularly buying and selling vehicles for cash, the IRS might classify you as a dealer—even if you don’t think of yourself that way.

For example, if you buy used cars, fix them up slightly, and sell them for a profit every few months, the IRS could argue that you’re in the business of selling cars. In that case, all your profits would be taxable as business income, and you’d need to report them on Schedule C of your tax return.

This doesn’t mean you can’t sell a few cars now and then. But if it becomes a pattern, you could cross the line into business activity. Keep track of how often you sell, how much profit you make, and whether you’re advertising or listing cars online. These factors help determine your tax status.

Cash Sales and IRS Reporting: What You Need to Know

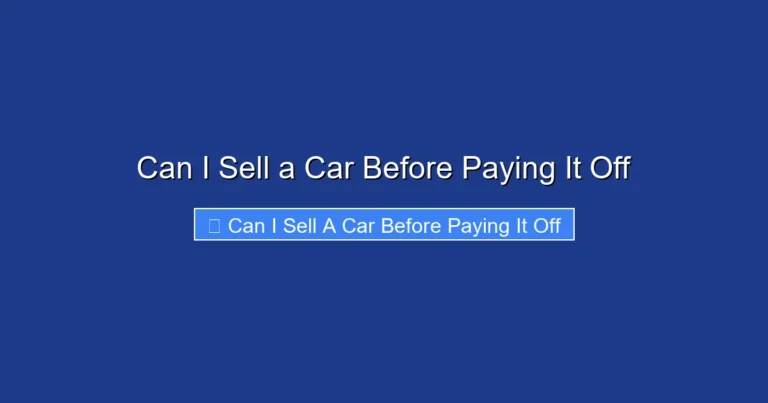

Visual guide about If I Sell My Car for Cash Do I Have to Pay Taxes

Image source: cdn.gobankingrates.com

One of the biggest misconceptions about selling a car for cash is that it’s “off the books” and invisible to the IRS. While it’s true that cash transactions aren’t automatically reported, that doesn’t mean they’re tax-free.

No 1099-K for Private Car Sales

Unlike selling items on platforms like eBay or Etsy, where payment processors issue 1099-K forms for transactions over $600, private car sales typically don’t generate tax forms. If you sell your car directly to a friend or through a classified ad and receive cash, no third party reports the transaction to the IRS.

That said, the lack of a 1099-K doesn’t exempt you from tax liability. You’re still responsible for reporting any taxable income—even if the IRS doesn’t know about the sale. It’s your job to keep accurate records and report gains if required.

When the IRS Might Find Out

Even without a 1099-K, the IRS has ways of discovering unreported income. For example, if you deposit a large sum of cash into your bank account, your bank may file a Currency Transaction Report (CTR) if the amount exceeds $10,000. While this doesn’t automatically trigger an audit, it can raise flags.

Additionally, if you’re audited for another reason—say, a discrepancy in your business expenses—the IRS might ask about other income sources, including car sales. That’s why honesty and documentation are your best defenses.

Best Practices for Cash Car Sales

To stay compliant and avoid trouble, follow these tips when selling your car for cash:

– Get a bill of sale: This document should include the buyer’s and seller’s names, addresses, vehicle details (VIN, make, model, year), sale price, and date. Both parties should sign it.

– Transfer the title properly: Make sure the title is signed over to the buyer and submitted to your state’s DMV. This protects you from liability if the car is involved in an accident after the sale.

– Keep records: Save the bill of sale, title transfer, and any receipts related to the car’s purchase and improvements. These help prove your cost basis if questioned.

– Report gains if necessary: If you made a significant profit—especially on a business vehicle—consider consulting a tax professional to determine if you need to report it.

State Tax Rules: Don’t Forget Local Laws

While federal tax rules are consistent across the U.S., state laws can vary. Some states have additional requirements or tax implications when selling a car.

Sales Tax vs. Income Tax

One common point of confusion is the difference between sales tax and income tax. When you sell your car, you don’t pay sales tax—the buyer does. In most states, the buyer pays sales tax when they register the vehicle with the DMV. The rate depends on the state and sometimes the county or city.

For example, in California, the buyer pays sales tax based on the purchase price or the vehicle’s current market value, whichever is higher. In Oregon, there’s no sales tax, so the buyer pays nothing. But in Texas, the tax is based on the sale price or the standard presumptive value (SPV), whichever is higher.

As the seller, you’re not responsible for collecting or remitting sales tax. That’s the buyer’s obligation. However, you should make sure the buyer understands this to avoid disputes.

State Reporting Requirements

Some states require sellers to report the sale to the DMV within a certain timeframe—usually 5 to 10 days. This is to protect you from liability if the car is used illegally after the sale. For example, in New York, you must file a Notice of Sale form online or by mail within 10 days.

Failure to report the sale can result in fines or continued liability for parking tickets, tolls, or accidents. So even if you’re not worried about taxes, it’s smart to check your state’s rules.

Special Cases: Gift Transfers and Family Sales

What if you sell your car to a family member for less than market value—or even for $1? These “gift-like” sales can have tax implications.

If you sell a car to a relative for significantly less than its fair market value, the IRS may treat the difference as a gift. For example, if your car is worth $10,000 and you sell it to your sister for $1, the $9,999 difference could be considered a taxable gift.

However, the annual gift tax exclusion is $18,000 per recipient in 2024 (up from $17,000 in 2023). That means you can give up to $18,000 to any one person without filing a gift tax return. So, if the difference is under that amount, you’re usually in the clear.

But if you’re transferring the car as a true gift—no money exchanged—you may need to file Form 709, the U.S. Gift Tax Return. Again, this is only required if the gift exceeds the annual exclusion.

Real-Life Examples: How Taxes Apply in Practice

Let’s look at a few real-world scenarios to see how these rules play out.

Example 1: Selling Your Daily Driver

Maria bought a 2018 Honda Civic for $18,000. After four years of use, she sells it for $12,000 in cash to a coworker. She loses $6,000.

Tax outcome: No taxes owed. This is a personal loss on a depreciating asset.

Example 2: Selling a Classic Car for a Profit

James bought a 1967 Ford Mustang for $25,000 as a hobby project. After restoring it, he sells it for $45,000.

Tax outcome: The $20,000 gain may be taxable as a capital gain. However, if the car was used personally and not as an investment, the IRS may not pursue it—but James should keep records in case of an audit.

Example 3: Selling a Business Vehicle

Carlos used a Ford Transit van for his plumbing business. He claimed $15,000 in depreciation over five years. He sells the van for $22,000; its original cost was $35,000, so its adjusted basis is $20,000.

Tax outcome: Carlos has a $2,000 gain. The IRS will treat this as taxable income, with part possibly recaptured as ordinary income due to depreciation.

Example 4: Selling Multiple Cars

Lisa buys used SUVs, cleans them up, and sells them online every few months. She makes $3,000–$5,000 per sale.

Tax outcome: The IRS may classify Lisa as a car dealer. All profits must be reported as business income on Schedule C, and she may owe self-employment tax.

Conclusion: Stay Informed, Stay Compliant

Selling your car for cash can be a smart financial move—but it’s important to understand the tax implications. In most cases, selling a personal vehicle won’t trigger a tax bill, especially if you sell it for less than you paid. However, if you’re selling a business vehicle, making a profit, or selling multiple cars, the rules change.

The key is to keep good records, know your cost basis, and understand whether your sale qualifies as personal or business activity. When in doubt, consult a tax professional. They can help you navigate complex situations and ensure you’re not overpaying—or underreporting.

Remember, just because a sale is in cash doesn’t mean it’s invisible. The IRS expects honesty, and a little preparation can save you from big headaches down the road. So go ahead, sell that car, enjoy the cash, and rest easy knowing you’ve handled it the right way.

Frequently Asked Questions

Do I have to pay taxes if I sell my car for cash?

In most cases, no—especially if you sell your personal car for less than you paid. The IRS doesn’t tax personal losses on depreciating assets like cars. However, if you make a profit or sell a business vehicle, taxes may apply.

What if I sell my car for more than I bought it for?

If you sell a personal car for a profit—like a classic or rare vehicle—the gain could be taxable as a capital gain. While the IRS rarely pursues small gains, it’s best to keep records in case of an audit.

Do I need to report a cash car sale to the IRS?

You only need to report the sale if you made a taxable gain, such as on a business vehicle or multiple sales. Private sales of personal cars under your cost basis don’t need to be reported.

Will I get a 1099 form when I sell my car for cash?

No. Private car sales don’t generate 1099 forms. Payment platforms only issue 1099-Ks for goods and services over $600, and most car sales are excluded.

What records should I keep after selling my car?

Keep the bill of sale, title transfer, and original purchase receipt. These help prove your cost basis and protect you in case of an audit or liability issue.

Can I sell my car to a family member without paying taxes?

Yes, but if you sell it for significantly less than market value, the difference may be considered a gift. As long as it’s under the annual gift tax exclusion ($18,000 in 2024), no tax is due.