What Happens If You Sell a Car with a Title Loan

Selling a car with a title loan is legally complex and financially risky. If you don’t handle it properly, you could still owe money, damage your credit, or even face legal action. Understanding the process and working with your lender is key to a clean, responsible sale.

So, you’ve got a car—maybe it’s been reliable for years, or maybe it’s starting to cost more in repairs than it’s worth. You’re thinking about selling it. But there’s one big catch: you still have a title loan on it. That means the lender holds the title as collateral until you pay off the debt. Now you’re wondering, “Can I even sell this car?” and “What happens if I do?”

The short answer? Yes, you *can* sell a car with a title loan—but it’s not as simple as handing over the keys and walking away. In fact, selling without following the right steps can land you in serious financial and legal trouble. You might end up owing money, hurting your credit score, or even facing a lawsuit. But don’t panic. With the right knowledge and planning, you can sell your car safely and responsibly, even with an outstanding title loan.

This guide will walk you through everything you need to know: what a title loan is, why it complicates a sale, the risks involved, and—most importantly—how to sell your car the right way. Whether you’re dealing with a private buyer or trading it in at a dealership, we’ll cover the steps, the paperwork, and the smart moves to protect yourself. By the end, you’ll know exactly what to do (and what not to do) when selling a car that still has a lien on it.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding Title Loans and How They Work

- 4 The Risks of Selling a Car with an Active Title Loan

- 5 How to Legally and Safely Sell a Car with a Title Loan

- 6 What to Do If You Can’t Pay Off the Loan Before Selling

- 7 Alternatives to Selling: What Else Can You Do?

- 8 Final Thoughts: Protect Yourself and Make the Right Choice

- 9 Frequently Asked Questions

- 9.1 Can I sell my car if I have a title loan?

- 9.2 What happens if I sell my car without paying off the title loan?

- 9.3 Can a dealership handle a title loan when I trade in my car?

- 9.4 Do I still owe money if I sell my car for less than I owe on the title loan?

- 9.5 How do I get the title released after paying off the loan?

- 9.6 Is it illegal to sell a car with a title loan?

Key Takeaways

- You can’t legally transfer ownership until the loan is paid off: The lender holds the title as collateral, so selling without clearing the debt violates loan terms.

- Selling without lender approval can trigger default: This may lead to repossession, lawsuits, or wage garnishment if you still owe money.

- The buyer may be at risk too: If the title isn’t properly cleared, they could lose the car or face legal issues down the road.

- You may still owe a deficiency balance: If the sale price is less than the loan amount, you’re responsible for the difference unless the lender forgives it.

- Communication with your lender is essential: Many lenders allow “payoff at sale” arrangements if you follow their process.

- Private sales require extra caution: Unlike trading in at a dealership, private buyers won’t handle the lien release—you must do it yourself.

- Document everything: Keep records of payments, communications, and the bill of sale to protect yourself legally and financially.

📑 Table of Contents

- Understanding Title Loans and How They Work

- The Risks of Selling a Car with an Active Title Loan

- How to Legally and Safely Sell a Car with a Title Loan

- What to Do If You Can’t Pay Off the Loan Before Selling

- Alternatives to Selling: What Else Can You Do?

- Final Thoughts: Protect Yourself and Make the Right Choice

Understanding Title Loans and How They Work

Before we dive into the sale process, let’s make sure we’re on the same page about what a title loan actually is. A title loan is a type of secured loan where you use your car’s title as collateral. That means you borrow money against the value of your vehicle, and the lender holds onto the physical title until you repay the loan in full. Unlike a traditional auto loan from a bank or credit union, title loans are often short-term, high-interest loans used by people who need quick cash and may not qualify for other forms of credit.

Here’s how it typically works: You apply for the loan, the lender evaluates your car’s value, and if approved, you sign an agreement. You get the cash, but you give the lender the title. You keep driving the car, but legally, the lender has a claim on it. Once you pay off the loan—including interest and fees—the lender releases the title back to you.

Now, here’s the key point: **as long as the loan is active, the lender owns the title**. That means you don’t have full legal ownership of the car. And in most states, you can’t transfer ownership to someone else unless the lien (the lender’s claim) is removed. So, if you try to sell the car without addressing the loan, you’re essentially trying to sell something you don’t fully own—and that’s a problem.

Why the Title Matters in a Car Sale

When you sell a car, the buyer needs a clean title to register it in their name. A “clean” title means there are no liens or claims against the vehicle. If your title still shows a lien from a title loan company, the buyer can’t legally take ownership until that lien is cleared. Think of it like selling a house with a mortgage—you can’t transfer the deed until the bank is paid off.

This creates a Catch-22: you need to sell the car to get money, but you can’t complete the sale until the loan is paid. And if you don’t have the cash to pay off the loan upfront, you’re stuck—unless you work with the lender and the buyer to structure the sale properly.

Common Misconceptions About Title Loans and Car Sales

A lot of people assume that because they’re still making payments, they “own” the car and can sell it anytime. That’s not true. Others think that if they sell the car for more than the loan balance, everything will work out. While that’s *possible*, it’s not guaranteed—and it doesn’t eliminate the need for proper paperwork and lender approval.

Another myth is that trading in the car at a dealership automatically handles the title loan. While dealerships are often equipped to manage liens, they still need cooperation from your lender. And if the trade-in value is less than what you owe, you’ll need to cover the difference—or negotiate a “cash-back” deal, which isn’t always allowed.

Understanding these basics is the first step to avoiding costly mistakes. Now let’s look at what happens if you ignore the rules.

The Risks of Selling a Car with an Active Title Loan

Visual guide about What Happens If You Sell a Car with a Title Loan

Image source: usamoneytoday.com

Selling a car with a title loan might seem like a quick fix—especially if you’re in a financial pinch. But doing it the wrong way can backfire in a big way. Let’s break down the real risks you could face.

Legal Consequences of Selling Without Paying Off the Loan

When you signed the title loan agreement, you likely agreed not to sell, transfer, or encumber the vehicle without the lender’s permission. Violating that agreement is a breach of contract. Depending on your state’s laws and the terms of your loan, the lender could declare the loan in default. That means they can demand immediate repayment of the full balance—plus fees and penalties.

In some cases, the lender may even have the right to repossess the car, even if it’s already been sold. Yes, you read that right: if the buyer doesn’t have a clear title, the lender can legally take the vehicle back. And if the buyer paid you money, they’ll come after you for a refund—or worse, sue you for fraud.

Financial Liability After the Sale

Let’s say you sell the car privately for $8,000, but you still owe $10,000 on the title loan. You pocket the $8,000 and think you’re done. Wrong. The lender still expects the remaining $2,000—plus any late fees or interest that accrued. This is called a **deficiency balance**, and you’re legally responsible for paying it.

If you don’t pay, the lender can send the debt to collections, sue you in court, or even garnish your wages. Your credit score will take a serious hit, making it harder to get loans, apartments, or even jobs in the future.

Damage to Your Credit Score

Defaulting on a title loan doesn’t just mean owing money—it also affects your credit. Most title lenders report to credit bureaus, so a missed payment or default will show up on your credit report. A single default can drop your score by 100 points or more. And because title loans are often seen as high-risk borrowing, lenders may view you as a risky borrower for years to come.

Even if you eventually pay off the deficiency, the negative mark can stay on your report for up to seven years. That’s a long time to carry the consequences of a rushed decision.

The Buyer’s Risk—And Why It Matters to You

You might think, “Well, I’m not the one buying the car—why should I care?” But if the buyer discovers later that the title isn’t clear, they could lose the car. And if they paid you in good faith, they’ll hold you accountable. You could face a civil lawsuit for selling a vehicle with a hidden lien. In some states, this is considered fraud.

Plus, word spreads. If you sell a car with a title loan and things go south, it could damage your reputation—especially if you’re planning to sell another vehicle in the future.

Real-Life Example: What Went Wrong

Take the case of Maria, a single mom in Texas who needed cash fast. She took out a $5,000 title loan on her 2012 Honda Civic. A few months later, her car broke down, and she decided to sell it to buy a more reliable used vehicle. She found a buyer online, negotiated a price of $6,000, and handed over the keys—without telling the buyer about the loan.

The buyer registered the car, but when they tried to get insurance, the company flagged the title as having an active lien. The lender repossessed the car a week later. The buyer sued Maria for $6,000 plus damages. Maria not only lost the sale money but also ended up owing the remaining $3,500 on the loan. Her credit score dropped by 120 points, and she spent months dealing with collections calls.

This story isn’t uncommon. It shows how one misstep can spiral into financial and legal chaos. The good news? It’s entirely avoidable.

How to Legally and Safely Sell a Car with a Title Loan

Visual guide about What Happens If You Sell a Car with a Title Loan

Image source: emmamcintyrephotography.com

Now that we’ve covered the risks, let’s talk solutions. Yes, you *can* sell your car with a title loan—but you need to do it the right way. Here’s a step-by-step guide to help you navigate the process safely and legally.

Step 1: Contact Your Lender First

Before you even list the car for sale, call your title loan lender. Explain that you want to sell the vehicle and ask about their process for releasing the title. Most lenders have a “payoff at sale” option, where the buyer’s payment goes directly to the lender to clear the debt.

Ask for:

– The exact payoff amount (including any fees or interest)

– The lender’s preferred method of payment (cashier’s check, wire transfer, etc.)

– Instructions for releasing the title after payment

– Whether they require a notarized letter or specific forms

Some lenders may even allow you to schedule a payoff date in advance, so you can coordinate with the buyer.

Step 2: Determine the Payoff Amount

The payoff amount is usually more than your current balance because it includes accrued interest and any prepayment penalties. For example, if you owe $7,000 today, the payoff might be $7,300 if you pay it off in 10 days.

Get this number in writing from the lender. Don’t rely on an estimate—ask for an official payoff quote that’s valid for at least 10–15 days. This gives you time to find a buyer and complete the sale.

Step 3: Find a Buyer (Private or Dealership)

You have two main options: sell privately or trade it in at a dealership.

**Private Sale:** You’ll get more money, but you’re responsible for handling the lien release. Make sure the buyer understands the process and is willing to pay via a secure method (like a cashier’s check made out to the lender).

**Dealership Trade-In:** Dealerships are used to handling liens. They’ll contact your lender, pay off the loan, and deduct any remaining balance from your trade-in value. If the car is worth more than the loan, they’ll give you the difference. If it’s worth less, you’ll need to pay the difference out of pocket.

Tip: Get quotes from multiple dealerships to ensure you’re getting a fair deal.

Step 4: Coordinate the Payoff and Title Transfer

Once you have a buyer and a payoff amount, it’s time to close the deal.

**For Private Sales:**

– Have the buyer pay the lender directly via cashier’s check or wire transfer.

– Once the lender receives payment, they’ll release the title.

– You’ll receive a lien release letter and the title (or a copy).

– Sign the title over to the buyer and complete a bill of sale.

– Submit the title and lien release to your state’s DMV to finalize the transfer.

**For Dealerships:**

– The dealership handles the payoff and title transfer.

– You’ll sign over the title and any required forms.

– The dealer pays the lender and takes ownership.

– You walk away with any equity—or pay any deficiency.

Step 5: Confirm the Lien Is Released

After the sale, follow up with your lender to confirm they’ve released the lien. Request a copy of the lien release letter and check your state’s DMV website to verify the title is now clear. This protects you in case the buyer tries to sell the car again or if there’s a dispute later.

Pro Tips for a Smooth Sale

– **Be transparent with the buyer.** Explain the title loan upfront. Most reasonable buyers will understand if you’re upfront and organized.

– **Use a secure payment method.** Never accept cash or personal checks for the full amount. A cashier’s check made out to the lender is safest.

– **Keep records.** Save all emails, receipts, and signed documents. You may need them if there’s a dispute.

– **Don’t rush.** Give yourself at least two weeks to complete the process. Rushing increases the risk of mistakes.

What to Do If You Can’t Pay Off the Loan Before Selling

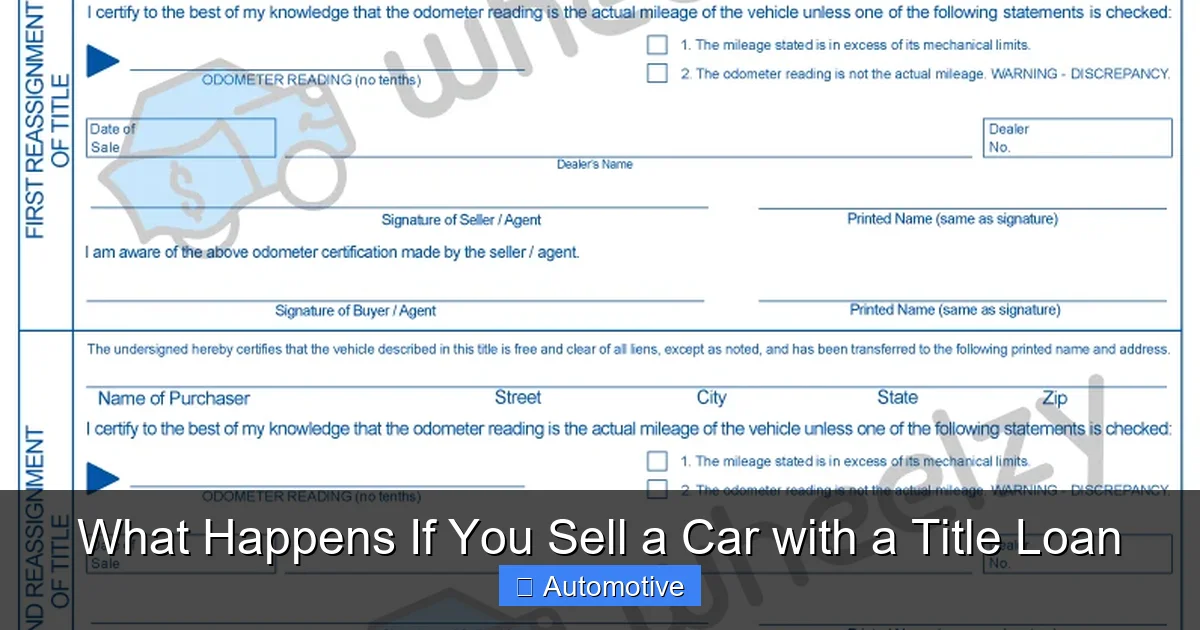

Visual guide about What Happens If You Sell a Car with a Title Loan

Image source: wheelzy.com

Sometimes, life happens. Maybe the car breaks down, or you lose your job. You need to sell the car, but you don’t have the money to pay off the title loan. What now?

Option 1: Negotiate with the Lender

Call your lender and explain your situation. Some lenders may offer a short-term extension, a payment plan, or even a settlement for less than the full amount. While not guaranteed, it’s worth asking—especially if you’ve been a reliable borrower.

Option 2: Sell to a Buyer Who Can Handle the Payoff

Some private buyers are willing to pay the lender directly, especially if the car is a good deal. You’ll need to be completely transparent and provide all the lender’s information. Make sure the buyer understands they’re paying the lender, not you.

Option 3: Trade In at a Dealership with Negative Equity

If your car is worth less than what you owe, some dealerships will “roll” the negative equity into a new loan. For example, if you owe $9,000 but the car is worth $7,000, the dealer might add the $2,000 to your new car loan. This isn’t ideal—it increases your debt—but it’s a way to move forward if you need a vehicle.

Option 4: Consider a Title Loan Refinance

If you’re struggling with high payments, refinancing with a lower-interest lender might free up cash. Some companies specialize in refinancing title loans. Use the savings to pay down the balance faster, then sell when you’re closer to payoff.

Alternatives to Selling: What Else Can You Do?

Selling isn’t your only option. Depending on your situation, you might consider other paths.

Keep the Car and Pay Off the Loan

If the car is still reliable, it might make sense to keep it and focus on paying off the loan. Create a budget, cut expenses, or take on a side gig to accelerate payments. Once the loan is paid, you’ll own the car free and clear—and can sell it later with no complications.

Voluntary Repossession (Last Resort)

If you can’t afford payments and can’t sell the car, you might consider voluntary repossession. This means returning the car to the lender. While it avoids the stress of involuntary repossession, it still damages your credit and you may still owe a deficiency balance.

Only consider this if you have no other options—and always talk to a credit counselor first.

Seek Help from a Nonprofit Credit Counselor

Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost advice. They can help you create a debt management plan, negotiate with lenders, or explore alternatives like debt consolidation.

Final Thoughts: Protect Yourself and Make the Right Choice

Selling a car with a title loan isn’t impossible—but it requires careful planning, honesty, and attention to detail. The key is to never try to “sneak” the sale past the lender. That path leads to financial pain, legal trouble, and long-term credit damage.

Instead, take control by communicating early, following the proper steps, and protecting both yourself and the buyer. Whether you sell privately or trade in at a dealership, the process is manageable when you know what to do.

Remember: a title loan is a serious financial commitment. But with the right approach, you can come out of it clean, debt-free, and with your integrity intact. Don’t let a short-term loan derail your long-term financial health. Take the time, do it right, and move forward with confidence.

Frequently Asked Questions

Can I sell my car if I have a title loan?

Yes, you can sell a car with a title loan, but you must pay off the loan first or coordinate the payoff with the buyer and lender. You cannot legally transfer ownership until the lien is released.

What happens if I sell my car without paying off the title loan?

Selling without paying off the loan violates your agreement and can lead to default, repossession, lawsuits, and a damaged credit score. You may still owe the remaining balance.

Can a dealership handle a title loan when I trade in my car?

Yes, most dealerships can pay off your title loan as part of the trade-in process. They’ll contact your lender, pay the payoff amount, and deduct any remaining balance from your trade value.

Do I still owe money if I sell my car for less than I owe on the title loan?

Yes, you’re responsible for the difference, known as a deficiency balance. The lender can pursue you for the remaining amount unless they agree to forgive it.

How do I get the title released after paying off the loan?

Once the lender receives full payment, they’ll send you a lien release letter and the title. Submit these to your state’s DMV to clear the title and complete the sale.

Is it illegal to sell a car with a title loan?

It’s not illegal to sell the car, but selling without clearing the lien or without lender approval can breach your contract and lead to legal and financial consequences.