How to Sell a Car That Has a Lien

Selling a car with a lien isn’t impossible—it just requires extra steps. You’ll need to pay off the loan or coordinate with your lender to release the title before or during the sale. With the right approach, you can sell your vehicle smoothly and legally, whether privately or through a dealership.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How to Sell a Car That Has a Lien: A Complete Guide

- 4 What Is a Lien on a Car?

- 5 Step-by-Step Process to Sell a Car with a Lien

- 6 Selling Privately with a Lien: Tips and Precautions

- 7 Selling to a Dealership or Car-Buying Service

- 8 Common Mistakes to Avoid

- 9 Final Thoughts: Selling with Confidence

- 10 Frequently Asked Questions

- 10.1 Can I sell my car if I still owe money on it?

- 10.2 What happens if I sell my car without paying off the lien?

- 10.3 How long does it take to get the title after paying off the loan?

- 10.4 Can a dealership pay off my loan when I sell my car?

- 10.5 Is it safe to use an escrow service for a private car sale?

- 10.6 What if my car is worth less than what I owe on the loan?

Key Takeaways

- Understand what a lien means: A lien gives your lender legal claim to your car until the loan is paid off. You can’t transfer full ownership until it’s cleared.

- Check your loan balance: Contact your lender to get the exact payoff amount, which may include fees or interest not shown in your monthly statement.

- Pay off the loan before selling: The cleanest method is to pay off the loan yourself, get the title released, and then sell the car with a clear title.

- Use an escrow service for private sales: If you can’t pay off the loan upfront, use a third-party escrow service to handle funds and title transfer securely.

- Dealerships can simplify the process: Many dealers will pay off your loan as part of the trade-in or purchase, making the transaction easier—but shop around for fair offers.

- Never skip the lien release: Failing to properly clear the lien can lead to legal issues, delays, or even liability after the sale.

- Keep records of everything: Save all communication with your lender, payoff confirmation, and bill of sale to protect yourself.

📑 Table of Contents

How to Sell a Car That Has a Lien: A Complete Guide

So, you’ve decided it’s time to sell your car—but there’s a catch: you still owe money on it. That means your vehicle has a lien, and you’re probably wondering, “Can I even sell this thing?” The short answer is yes, you can. But it’s not as simple as handing over the keys and walking away. Selling a car with a lien requires careful planning, clear communication with your lender, and a solid understanding of the legal steps involved.

Don’t panic. Thousands of people sell cars every year while still making payments. Whether you’re trading in your ride at a dealership or selling it privately to a friend or stranger, the process is manageable—if you follow the right steps. The key is knowing how to handle the lien, which is essentially a legal claim your lender has on the vehicle until the loan is fully paid. Once that claim is released, you’re free to transfer ownership. But until then, you can’t legally sell the car without addressing the debt.

In this guide, we’ll walk you through everything you need to know about selling a car that has a lien. From understanding what a lien is to choosing the best selling method, we’ll cover the practical steps, common mistakes to avoid, and tips to make the process as smooth as possible. Whether you’re dealing with a bank, credit union, or online lender, the principles remain the same. Let’s get started.

What Is a Lien on a Car?

Visual guide about How to Sell a Car That Has a Lien

Image source: moneymink.com

Before you can sell your car, it’s important to understand exactly what a lien is and how it affects your ability to transfer ownership. In simple terms, a lien is a legal right that a lender has over your vehicle until you’ve paid off your auto loan. Think of it as a safety net for the bank or financial institution that lent you the money to buy the car. They want to make sure they get their money back, so they place a lien on the title—meaning they technically have a claim to the vehicle.

When you take out a car loan, the lender becomes the “lienholder,” and their name is listed on the title along with yours. This doesn’t mean they own the car, but it does mean they have a legal interest in it. As long as the lien is active, you can’t sell the car and transfer full ownership to someone else. The title can’t be signed over until the lien is removed.

For example, imagine you bought a 2020 Honda Civic for $25,000 with a 5-year loan. Even though you drive the car every day and make monthly payments, the bank still holds the title. If you tried to sell the car today without paying off the loan, the buyer wouldn’t be able to register it in their name because the title is still tied to the lender. That’s why clearing the lien is a non-negotiable step in the selling process.

It’s also worth noting that liens aren’t just for new cars. If you financed a used vehicle, the same rules apply. And if you’ve refinanced your loan or rolled negative equity into a new loan, the lien may have changed hands from one lender to another. Always check your current loan documents or contact your lender to confirm who holds the lien.

How to Check if Your Car Has a Lien

Not sure if your car has a lien? It’s easier to check than you might think. Start by looking at your vehicle’s title. If you have a physical copy, check the “lienholder” section. If a bank or financial institution is listed there, you have a lien. If you don’t have the title handy, you can request a copy from your state’s Department of Motor Vehicles (DMV). Most states allow you to order a duplicate title online, by mail, or in person.

Another way to verify the lien status is by contacting your lender directly. Call the customer service number on your loan statement or log into your online account. Ask for a payoff quote and confirm whether the lien is still active. Some lenders also provide this information through automated phone systems or mobile apps.

You can also check your credit report. While it won’t show the lienholder’s name, it will list your auto loan and current balance. If the loan is still open, there’s a good chance the lien is still in place.

Why Liens Matter When Selling

Selling a car with a lien isn’t just a paperwork issue—it’s a legal one. If you try to sell the car without clearing the lien, you could face serious consequences. The buyer won’t be able to register the vehicle, which means they can’t legally drive it. That could lead to disputes, canceled sales, or even legal action against you.

Additionally, if the buyer pays you and you fail to pay off the loan, the lender could repossess the car—even if it’s no longer in your possession. That leaves the buyer high and dry and could result in financial and legal trouble for you. In short, skipping the lien release is a risky move that could cost you money, time, and your reputation.

Step-by-Step Process to Sell a Car with a Lien

Visual guide about How to Sell a Car That Has a Lien

Image source: lh4.googleusercontent.com

Now that you understand what a lien is and why it matters, let’s dive into the actual process of selling your car. There are a few different ways to handle it, but they all follow a similar framework. The goal is to either pay off the loan before the sale or coordinate with your lender and the buyer to clear the debt during the transaction.

Here’s a step-by-step breakdown of how to sell a car that has a lien:

Step 1: Determine the Payoff Amount

The first thing you need to do is find out exactly how much you owe. This isn’t just your monthly payment multiplied by the number of months left. The payoff amount includes any remaining principal, accrued interest, and possibly prepayment penalties or fees.

Contact your lender and request a “payoff quote.” This is a document that shows the total amount needed to pay off the loan in full, usually valid for 10 to 30 days. Be sure to ask if there are any additional fees, such as a title release fee or processing charge.

For example, let’s say you have 24 months left on your loan with a monthly payment of $400. You might assume you owe $9,600. But the actual payoff could be $9,800 due to interest and fees. Getting an accurate quote ensures you don’t come up short when it’s time to settle the debt.

Step 2: Decide How to Handle the Payoff

Once you know the payoff amount, you have two main options: pay it off yourself before selling, or arrange for the buyer (or dealer) to pay it off as part of the sale.

If you have the funds, paying off the loan yourself is the cleanest and most straightforward method. You’ll get the title released, and then you can sell the car with a clear title—just like any other used vehicle. This gives you more control over the sale and avoids complications.

If you don’t have the money to pay off the loan, you’ll need to coordinate with the buyer or a dealership. In a private sale, you can use an escrow service to hold the buyer’s payment until the loan is paid and the title is transferred. With a dealership, they often handle the payoff directly as part of the trade-in or purchase process.

Step 3: Choose Your Selling Method

Your next decision is how to sell the car. You can sell it privately, trade it in at a dealership, or sell it to a car-buying service like CarMax or Vroom. Each option has pros and cons when it comes to handling a lien.

Private sales usually offer the highest price, but they require more work and coordination. You’ll need to find a buyer, negotiate the price, and manage the lien release process. Dealerships and car-buying services are more convenient—they often pay off the loan for you—but you might get less money for your car.

Consider your priorities. If you want top dollar and don’t mind the extra effort, go private. If you value convenience and speed, a dealership might be the better choice.

Step 4: Coordinate the Lien Release

This is the most critical part of the process. Once the buyer pays you (or the dealer pays off the loan), you must ensure the lien is officially released.

If you paid off the loan yourself, your lender will send you the title with the lien released. This can take a few days to a few weeks, depending on the lender. Once you have it, you can sign the title over to the buyer and complete the sale.

If the buyer or dealer is paying off the loan, make sure the payment goes directly to the lender—not to you. Provide the buyer with your lender’s payoff information, including the account number and mailing address. Some lenders allow online payments, which can speed up the process.

After the loan is paid, the lender will release the lien and send the title to you or the buyer, depending on your state’s rules. In some states, the title goes to the buyer directly. In others, it comes to you first, and you must sign it over.

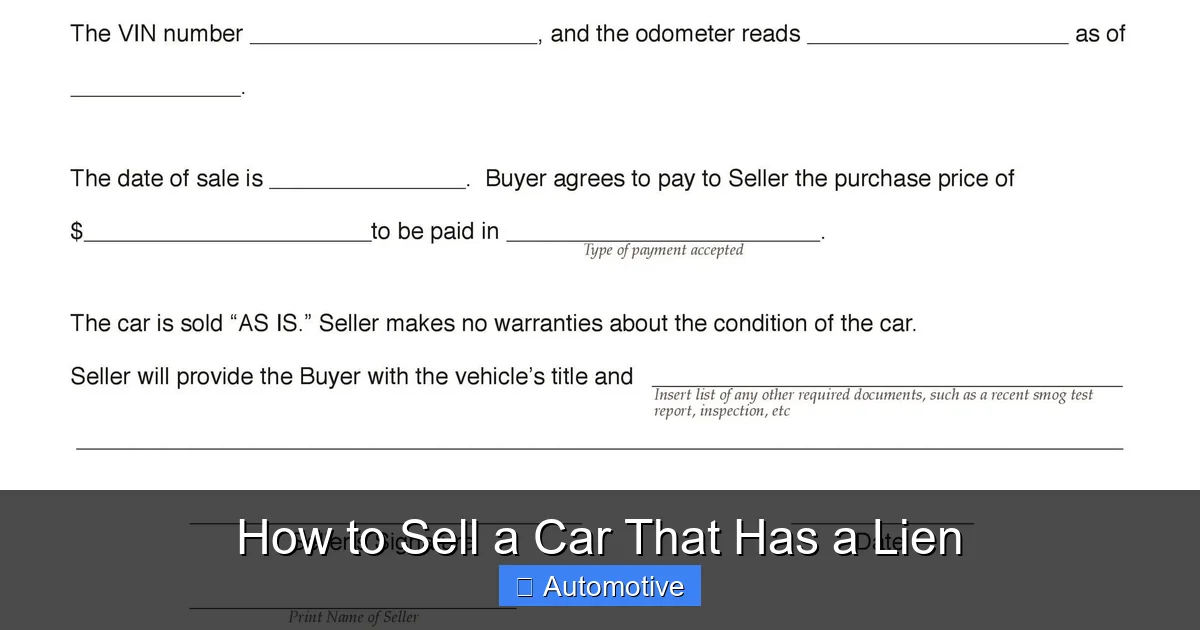

Step 5: Complete the Sale and Transfer Ownership

Once the lien is released and you have a clear title, you can finalize the sale. Sign the title over to the buyer, complete a bill of sale, and provide any required documentation, such as a release of liability form.

Make sure to keep copies of all paperwork, including the payoff confirmation and bill of sale. This protects you in case of any disputes later.

Selling Privately with a Lien: Tips and Precautions

Visual guide about How to Sell a Car That Has a Lien

Image source: quickautotags.com

Selling your car privately while it has a lien can be rewarding—but it comes with extra responsibilities. Since you’re dealing directly with a buyer, you’ll need to manage the lien release process carefully to avoid scams or legal issues.

Use an Escrow Service

One of the safest ways to sell a car with a lien privately is to use an escrow service. An escrow company acts as a neutral third party that holds the buyer’s payment until the loan is paid and the title is transferred.

Here’s how it works: The buyer sends the payment to the escrow service. You provide the lender’s payoff information. The escrow service pays off your loan directly and ensures the title is released. Once the lien is cleared, the title is transferred to the buyer, and the escrow service releases any remaining funds to you.

This method protects both parties. The buyer knows their money is safe until the car is legally theirs. You know the loan will be paid and the title will be transferred properly.

Popular escrow services include Escrow.com and PaySAFE. Be sure to choose a reputable company and avoid any service that asks for upfront fees or seems suspicious.

Meet in a Safe, Public Location

When meeting with a potential buyer, always choose a safe, public place—like a police station parking lot or a busy shopping center. Avoid meeting at your home or in isolated areas. Bring a friend if possible, and let someone know where you’re going and when you expect to return.

Verify the Buyer’s Payment Method

Never accept personal checks or wire transfers from unknown sources. These can bounce or be fraudulent. Cash, cashier’s checks, or verified electronic transfers are safer options. If using a cashier’s check, verify it with the bank before handing over the car.

Don’t Hand Over the Car Until the Lien Is Cleared

This is crucial. Even if the buyer pays you, don’t give them the car until the loan is paid and the lien is released. Otherwise, they could drive off with your car, and you’d still be responsible for the loan. The lender could repossess the vehicle, and you’d be stuck with the debt.

Selling to a Dealership or Car-Buying Service

If the idea of managing a private sale feels overwhelming, selling to a dealership or car-buying service might be the better option. These businesses are experienced in handling liens and can often streamline the process.

How Dealerships Handle Liens

When you trade in or sell your car to a dealership, they typically pay off your loan as part of the transaction. Here’s how it usually works:

You bring your car to the dealership and get an appraisal. The dealer offers you a price, which may be applied as a trade-in credit or paid directly to you. If the offer is less than your loan balance, you’ll need to pay the difference (called “negative equity”). If the offer is more, you’ll receive the surplus.

The dealer then contacts your lender, pays off the loan, and handles the title transfer. Once the lien is released, the dealer owns the car and can resell it.

This process is convenient because the dealer manages all the paperwork. However, you may get less money than you would in a private sale, since dealers need to make a profit.

Selling to Online Car Buyers

Companies like CarMax, Vroom, and Carvana also buy cars with liens. The process is similar to selling to a dealership. You get an online quote, schedule an inspection, and if you accept the offer, they pay off your loan and take ownership of the car.

These services are fast and hassle-free, but again, you might not get the highest price. Still, the convenience and peace of mind can be worth it.

Common Mistakes to Avoid

Selling a car with a lien isn’t rocket science, but it’s easy to make mistakes if you’re not careful. Here are some common pitfalls to watch out for:

Not Getting a Payoff Quote

Assuming you know how much you owe based on your monthly payment is a big mistake. Always get an official payoff quote from your lender. Interest and fees can add up, and you don’t want to be surprised at the last minute.

Accepting Payment Before the Lien Is Released

Never take money from a buyer and promise to pay off the loan later. If the buyer drives away with the car and you fail to pay the loan, the lender can repossess it—and you’ll still owe the debt. Always ensure the loan is paid and the lien is cleared before transferring ownership.

Forgetting to Notify the DMV

After the sale, you must notify your state’s DMV that you’ve sold the car. This protects you from liability if the buyer gets a ticket or is involved in an accident. Most states allow you to file a release of liability form online or by mail.

Not Keeping Records

Save all documents related to the sale, including the bill of sale, payoff confirmation, and communication with your lender. These records can help resolve disputes and prove you fulfilled your obligations.

Final Thoughts: Selling with Confidence

Selling a car that has a lien might seem complicated, but it’s entirely doable with the right approach. The key is to stay organized, communicate clearly with your lender, and choose a selling method that fits your needs. Whether you go private or sell to a dealer, the process becomes much smoother when you understand the steps and plan ahead.

Remember, the lien isn’t a barrier—it’s just a step in the process. By paying off the loan or coordinating the payoff with your buyer or dealer, you can sell your car legally and ethically. And once the lien is cleared, you’ll have a clean title and a successful sale under your belt.

Take your time, ask questions, and don’t rush into anything. With a little patience and preparation, you’ll be driving away in your new ride—or cashing that check—before you know it.

Frequently Asked Questions

Can I sell my car if I still owe money on it?

Yes, you can sell a car that has a lien, but you must pay off the loan or coordinate with your lender to release the title before or during the sale. You cannot transfer full ownership until the lien is cleared.

What happens if I sell my car without paying off the lien?

If you sell the car without clearing the lien, the buyer cannot register it, and the lender may repossess the vehicle. You could still be held responsible for the remaining loan balance, even after the sale.

How long does it take to get the title after paying off the loan?

The time varies by lender and state, but it typically takes 7 to 21 days to receive the title after the loan is paid in full. Some lenders offer expedited processing for an additional fee.

Can a dealership pay off my loan when I sell my car?

Yes, most dealerships will pay off your existing loan as part of the trade-in or purchase process. They handle the payoff directly with your lender and manage the title transfer.

Is it safe to use an escrow service for a private car sale?

Yes, using a reputable escrow service is a safe way to handle a private sale with a lien. It ensures the loan is paid and the title is transferred before funds are released to you.

What if my car is worth less than what I owe on the loan?

If your car has negative equity, you’ll need to pay the difference out of pocket when selling. Some buyers may agree to cover part of the gap, or you can roll the difference into a new loan if trading in.