How Much Do Car Dealerships Sell For

Car dealerships can sell for anywhere from $1 million to over $50 million, depending on brand, location, and financial performance. Understanding the valuation process helps buyers and sellers make informed decisions in this high-stakes market.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Do Car Dealerships Sell For? A Complete Guide

- 4 What Determines the Sale Price of a Car Dealership?

- 5 How Are Car Dealerships Valued?

- 6 Real Estate: The Hidden Value Driver

- 7 Market Trends Affecting Dealership Sale Prices

- 8 How to Buy or Sell a Car Dealership

- 9 Real-World Examples of Dealership Sales

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 What is the average price of a car dealership?

- 11.2 Do dealerships include real estate in the sale price?

- 11.3 Can you buy a car dealership without experience?

- 11.4 How long does it take to sell a car dealership?

- 11.5 What happens to employees when a dealership is sold?

- 11.6 Are car dealerships a good investment?

Key Takeaways

- Dealership prices vary widely: Small independent lots may sell for under $1 million, while large franchised dealerships in prime areas can fetch $30 million or more.

- Franchise brand matters: Luxury and high-demand brands like BMW, Mercedes-Benz, and Toyota typically command higher sale prices due to stronger customer loyalty and profit margins.

- Location is a major factor: Dealerships in urban or high-traffic suburban areas with strong economies sell for significantly more than those in rural or declining markets.

- Financial performance drives value: Buyers closely examine revenue, net profit, inventory turnover, and service department earnings when determining a fair price.

- Real estate adds significant value: In many cases, the land and building account for 40–60% of the total sale price, especially in desirable commercial zones.

- Market trends influence timing: Economic conditions, interest rates, and consumer demand for new vs. used vehicles can affect how much dealerships sell for at any given time.

- Professional appraisal is essential: Accurate valuation requires a detailed analysis by experienced brokers or appraisers familiar with automotive retail.

📑 Table of Contents

- How Much Do Car Dealerships Sell For? A Complete Guide

- What Determines the Sale Price of a Car Dealership?

- How Are Car Dealerships Valued?

- Real Estate: The Hidden Value Driver

- Market Trends Affecting Dealership Sale Prices

- How to Buy or Sell a Car Dealership

- Real-World Examples of Dealership Sales

- Conclusion

How Much Do Car Dealerships Sell For? A Complete Guide

If you’ve ever wondered how much car dealerships sell for, you’re not alone. Whether you’re an entrepreneur looking to enter the automotive retail world, a current owner considering selling, or just curious about the economics behind the industry, understanding dealership pricing is both fascinating and practical. The truth is, there’s no one-size-fits-all answer. The sale price of a car dealership can range from under $1 million to well over $50 million—sometimes even more.

So, what determines where a dealership falls on that spectrum? It’s not just about how many cars are on the lot. A dealership’s value is shaped by a complex mix of factors including brand affiliation, location, financial health, real estate value, and market conditions. Unlike buying a car, where sticker prices are relatively transparent, dealership sales are private transactions that require deep analysis. This article will walk you through everything you need to know about how much car dealerships sell for, what drives their value, and how buyers and sellers can navigate this unique market.

What Determines the Sale Price of a Car Dealership?

Visual guide about How Much Do Car Dealerships Sell For

Image source: carcareassist.com

The price of a car dealership isn’t pulled out of thin air. It’s the result of a detailed valuation process that considers both tangible and intangible assets. At its core, a dealership is a business—and like any business, its worth is based on its ability to generate profit. But unlike a typical retail store, a dealership’s value is deeply tied to its franchise agreement, real estate, inventory, and customer base.

One of the biggest misconceptions is that the number of cars on the lot determines the price. While inventory is important, it’s just one piece of the puzzle. A dealership with 200 cars but low sales volume and poor service revenue may be worth far less than a smaller lot with strong customer loyalty and high-profit margins. Buyers are looking for sustainable income, not just flashy inventory.

Another key factor is the franchise brand. A Toyota or Honda dealership in a growing suburb will typically sell for more than an independent used car lot, even if the latter has more vehicles. That’s because franchised dealers benefit from manufacturer support, brand recognition, and access to new models—assets that are hard to replicate.

Franchise Brand and Manufacturer Relationships

The brand a dealership represents plays a massive role in its valuation. Luxury brands like BMW, Mercedes-Benz, Audi, and Lexus often command premium prices because they attract high-income customers and generate strong margins on both new and used vehicles. These dealerships also tend to have larger service departments, which contribute significantly to long-term profitability.

For example, a Mercedes-Benz dealership in a metropolitan area like Atlanta or Dallas might sell for $25 million or more, while a similar-sized Honda dealership in the same city could go for $15–$20 million. The difference comes down to brand prestige, customer lifetime value, and manufacturer incentives.

But it’s not just about luxury. High-volume brands like Ford, Chevrolet, and Toyota also hold strong value due to their widespread popularity and reliable sales pipelines. These brands often have long waiting lists for new franchises, which increases demand and, in turn, sale prices.

Independent dealerships—those without a manufacturer franchise—are a different story. While they offer flexibility, they lack the built-in customer base and support that come with a brand. As a result, they typically sell for much less, often in the $1–$5 million range, depending on size and location.

Location, Location, Location

You’ve heard it before in real estate, and it’s just as true for car dealerships: location is everything. A dealership situated on a busy highway with high visibility and easy access will almost always sell for more than one tucked away on a side street, even if the financials are similar.

Urban and suburban areas with growing populations and strong economies are prime real estate for dealerships. Cities like Austin, Nashville, and Raleigh have seen explosive growth in automotive retail, driving up sale prices. In these markets, dealerships aren’t just businesses—they’re valuable commercial properties.

Consider this: a Ford dealership in downtown Denver might sell for $30 million, while a similar dealership in a rural part of Kansas could go for $8 million. The difference isn’t just in sales volume—it’s in land value. In high-demand areas, the real estate alone can account for half or more of the total sale price.

Even within a city, location matters. A dealership near a major shopping center or transportation hub will attract more foot traffic and impulse buyers. Visibility from the road, ample parking, and proximity to competitors (which can create a “car row” effect) all add to a dealership’s appeal.

Financial Performance and Profitability

At the end of the day, buyers want to know one thing: how much money can this dealership make? That’s why financial performance is the cornerstone of any valuation. Buyers will scrutinize income statements, balance sheets, and tax returns from the past three to five years.

Key metrics include:

– Annual revenue (from new and used car sales, service, parts, and financing)

– Net profit margin

– Inventory turnover rate

– Service department profitability

– Customer retention and repeat business

A dealership that consistently earns $2 million in net profit annually will be worth far more than one with $5 million in revenue but only $500,000 in profit. Efficiency matters. Buyers look for lean operations, strong management, and diversified income streams.

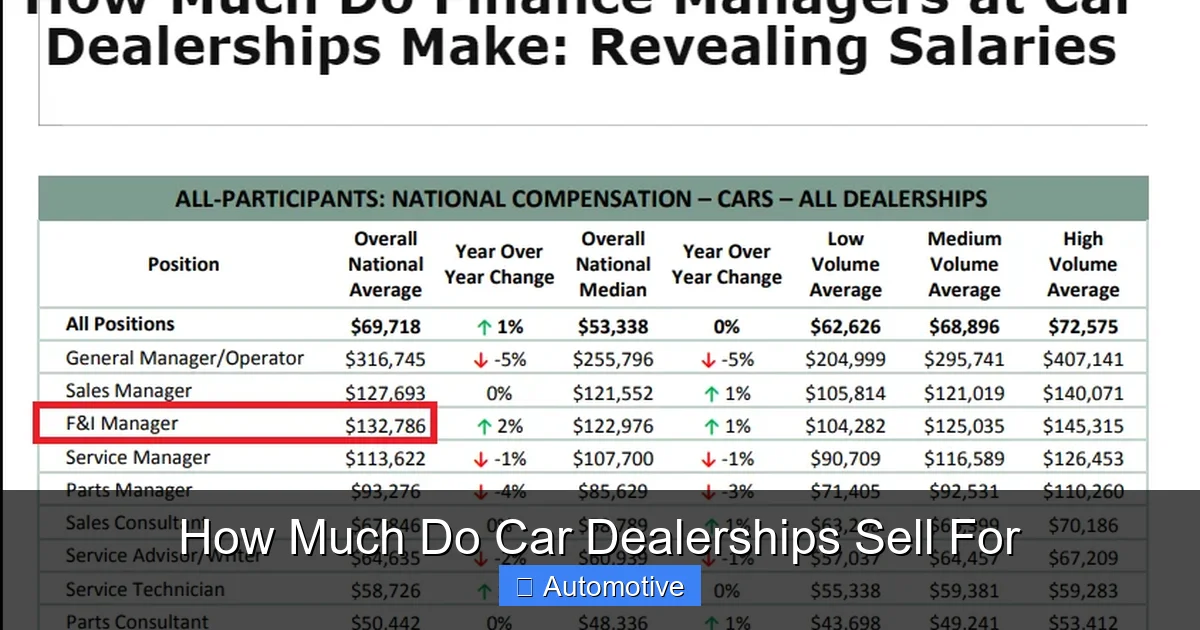

Service departments are especially valuable. While car sales can fluctuate with the economy, service and maintenance provide steady, recurring revenue. A dealership with a busy service center that generates $1.5 million annually in profit can add millions to its overall value.

How Are Car Dealerships Valued?

Visual guide about How Much Do Car Dealerships Sell For

Image source: carcareassist.com

Valuing a car dealership isn’t as simple as multiplying annual revenue by a fixed number. It requires a nuanced approach that combines several methods to arrive at a fair market price. The most common valuation techniques include the income approach, asset-based approach, and market comparison method.

Income Approach: The Earnings Multiplier

The income approach is the most widely used method for dealership valuation. It focuses on the dealership’s ability to generate future cash flow. The core idea is to apply a multiplier to the dealership’s adjusted net income to estimate its value.

For example, if a dealership has an adjusted net income of $1.5 million and the industry multiplier is 5x, the estimated value would be $7.5 million. But what determines the multiplier?

Multipliers vary based on risk, growth potential, and market conditions. A stable, well-run Toyota dealership in a growing market might command a 6x or 7x multiplier. A struggling independent lot with declining sales might only get 3x or 4x.

Adjustments are also critical. Buyers will “normalize” the financials by removing one-time expenses, owner perks, or unusual losses to get a true picture of ongoing profitability. For instance, if the owner paid themselves $500,000 in salary but the market rate is $200,000, that $300,000 difference would be added back to income before applying the multiplier.

Asset-Based Valuation: What’s It Worth on Paper?

The asset-based approach looks at the dealership’s tangible and intangible assets minus its liabilities. This method is especially important when real estate is involved.

Tangible assets include:

– Land and buildings

– Inventory (new and used vehicles, parts)

– Equipment (lifts, diagnostic tools, computers)

– Furniture and fixtures

Intangible assets include:

– Franchise agreement (often the most valuable intangible asset)

– Customer database and loyalty

– Brand reputation

– Leasehold improvements (if renting)

For example, a dealership might have $10 million in real estate, $3 million in inventory, $1 million in equipment, and a franchise agreement valued at $5 million. If liabilities total $4 million, the net asset value would be $15 million.

However, this method has limitations. It doesn’t fully capture future earning potential, which is why it’s often used in conjunction with the income approach.

Market Comparison: What Are Similar Dealerships Selling For?

The market comparison method looks at recent sales of similar dealerships in the same region or with similar characteristics. This “comps” approach helps validate the valuation from other methods.

For instance, if three Honda dealerships in Florida sold for 5.5x, 6x, and 6.5x their net income over the past year, a buyer might use 6x as a benchmark for a similar dealership.

But finding true comparables can be challenging. No two dealerships are exactly alike. Differences in management, customer base, and facility condition can affect pricing. That’s why experienced brokers and appraisers are essential—they have access to private sales data and industry trends.

Real Estate: The Hidden Value Driver

Visual guide about How Much Do Car Dealerships Sell For

Image source: whatincar.com

One of the most overlooked aspects of dealership valuation is real estate. In many cases, the land and building are worth as much—or more—than the business itself.

Land Value in Prime Locations

In high-demand commercial areas, dealership real estate can be worth millions. A 5-acre lot on a major highway in Los Angeles or Miami might be valued at $15–$20 million on its own. Even if the dealership business is only worth $10 million, the total sale price could exceed $25 million.

This is why some buyers purchase dealerships primarily for the real estate. They may operate the business for a few years before selling the land to a developer or converting it to another use.

Lease vs. Own: Impact on Sale Price

Dealerships that lease their property face different valuation dynamics. While leasing reduces upfront costs, it can limit the sale price because the buyer doesn’t own a major asset.

For example, a dealership with strong financials but a leased building might sell for $8 million, while an identical dealership that owns its land could go for $15 million. The difference is the real estate equity.

However, long-term leases in prime locations can still add value, especially if the lease terms are favorable and transferable. Buyers will assess the remaining lease term, rent costs, and renewal options.

Zoning and Development Potential

Zoning laws can also affect value. A dealership located in an area zoned for mixed-use development might be worth more to a buyer planning to redevelop the site. Even if the current owner has no such plans, the potential can inflate the price.

For instance, a dealership in a suburban area that’s being rezoned for residential and retail use could see its value jump significantly—even if the car business is unchanged.

Market Trends Affecting Dealership Sale Prices

The automotive retail landscape is constantly evolving, and these changes directly impact how much dealerships sell for.

Rise of Electric Vehicles (EVs)

The shift toward electric vehicles is reshaping the industry. Dealerships that have invested in EV infrastructure—such as charging stations, technician training, and inventory—are becoming more valuable.

For example, a Tesla-authorized service center or a Ford dealership with a strong EV lineup may command a premium due to future growth potential. Buyers are willing to pay more for dealerships positioned to capitalize on the EV transition.

Conversely, dealerships slow to adapt may see declining values as consumer preferences shift.

Franchise Consolidation and Multi-Brand Groups

The trend toward consolidation means that large dealership groups are buying smaller, independent lots. These groups benefit from economies of scale, shared marketing, and centralized management.

As a result, individual dealerships that are part of a larger network may sell for more than standalone operations. Buyers see the value in integration and operational efficiency.

For example, a single Chevrolet dealership might sell for $10 million, but if it’s part of a 10-dealership group, the entire package could go for $120 million—more than 10 times the individual value due to synergies.

Interest Rates and Financing Costs

Economic conditions play a major role in dealership sales. When interest rates are low, buyers can finance purchases more easily, driving up demand and prices. Conversely, high interest rates can cool the market.

For instance, during the 2020–2021 period of low rates, dealership sales surged, with prices reaching record highs. But as rates rose in 2022–2023, some buyers pulled back, leading to more cautious pricing.

How to Buy or Sell a Car Dealership

Whether you’re looking to buy or sell, the process requires careful planning and professional guidance.

Selling Your Dealership: Steps to Maximize Value

If you’re a dealership owner considering a sale, start by getting your financials in order. Clean up your books, reduce unnecessary expenses, and document all revenue streams.

Next, consider hiring a business broker who specializes in automotive retail. They can help you prepare a confidential information memorandum (CIM), market the dealership to qualified buyers, and negotiate the best deal.

Timing is also important. Selling during a strong economy or when your brand is in high demand can boost your price. Avoid selling during downturns or when your inventory is outdated.

Finally, be prepared for due diligence. Buyers will want to review everything from tax returns to employee contracts to environmental reports.

Buying a Dealership: What to Look For

For buyers, the key is due diligence. Don’t fall in love with the shiny cars—focus on the numbers.

Start by reviewing the dealership’s financial performance over the past three to five years. Look for consistent profitability, strong service revenue, and low debt.

Visit the location at different times of day to assess traffic and visibility. Talk to employees and customers to gauge morale and satisfaction.

Also, verify the franchise agreement. Make sure it’s transferable and that the manufacturer approves the sale. Some brands have strict rules about who can own a dealership.

Finally, get a professional appraisal and consider hiring a lawyer and accountant to review the deal.

Real-World Examples of Dealership Sales

To put theory into practice, let’s look at a few real-world examples.

Example 1: Luxury Dealership in a Major City

A BMW dealership in Chicago sold for $42 million in 2022. The sale included a 10-acre property, $8 million in inventory, and a franchise agreement. The dealership generated $3.5 million in annual net profit, resulting in a 12x earnings multiple—higher than average due to the prime location and strong brand.

Example 2: Mid-Size Franchise in a Growing Suburb

A Toyota dealership in a fast-growing suburb of Nashville sold for $18 million in 2023. The buyer was a regional dealership group looking to expand. The sale price reflected $12 million in real estate, $4 million in inventory, and $2 million in goodwill. The dealership had $2.2 million in net income, selling at approximately 8x earnings.

Example 3: Independent Used Car Lot

A family-owned used car dealership in rural Ohio sold for $2.5 million in 2021. The sale included a 2-acre lot, $1 million in inventory, and $500,000 in equipment. With $400,000 in annual profit, it sold at a 6.25x multiple—typical for smaller, independent operations.

Conclusion

So, how much do car dealerships sell for? The answer is: it depends. From under $1 million for a small independent lot to over $50 million for a luxury franchise in a prime location, the range is vast. But beneath the numbers lies a clear pattern: value is driven by brand strength, location, financial performance, and real estate.

Whether you’re buying or selling, understanding these factors is essential. Work with experienced professionals, do your homework, and don’t rush the process. The automotive retail market is competitive, but with the right strategy, it can be incredibly rewarding.

Remember, a dealership isn’t just a place to buy cars—it’s a business, a piece of real estate, and often, a legacy. Treat it with the respect it deserves, and you’ll be well on your way to a successful transaction.

Frequently Asked Questions

What is the average price of a car dealership?

The average sale price of a car dealership varies widely, but most franchised dealerships sell between $5 million and $25 million. Smaller independent lots may go for under $3 million, while large luxury dealerships in major cities can exceed $50 million.

Do dealerships include real estate in the sale price?

Yes, in most cases the real estate—land and building—is included in the sale price, especially if the dealership owns the property. This can account for 40–60% of the total value in prime locations.

Can you buy a car dealership without experience?

It’s possible, but challenging. Most manufacturers require franchise buyers to have automotive retail experience or hire experienced managers. Working with a broker and hiring a strong management team can help overcome this barrier.

How long does it take to sell a car dealership?

The sale process typically takes 6 to 12 months, depending on market conditions, due diligence, and manufacturer approval. Preparing the business for sale in advance can speed up the timeline.

What happens to employees when a dealership is sold?

In most cases, employees are retained by the new owner, especially key managers and service technicians. However, the new owner may restructure roles or make changes based on their business model.

Are car dealerships a good investment?

Yes, for the right buyer. Dealerships can offer strong cash flow, asset appreciation, and long-term growth, especially in growing markets. However, they require significant capital, management expertise, and industry knowledge to succeed.

![Do Window Tints Go On The Inside Or Outside? (Complete Expert Breakdown) 5 Window Tinting Laws in Virginia [Updated, 2023] What Every Driver Needs to Know Before Hitting the Road](https://aautomotives.com/wp-content/uploads/2025/10/Window-Tinting-Laws-in-Virginia-Updated-2023-What-Every-Driver-Needs-to-Know-Before-Hitting-the-Road-1-768x412.jpg)