Can You Sell Back Your Car to the Dealership

Yes, you can sell back your car to the dealership through a trade-in or direct purchase. While convenient, it’s important to understand how dealers value vehicles and negotiate wisely to maximize your return.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can You Sell Back Your Car to the Dealership?

- 4 How Does Selling Your Car to a Dealership Work?

- 5 What Affects Your Car’s Trade-In Value?

- 6 How to Get the Best Offer When Selling Back Your Car

- 7 Tax Benefits and Financial Considerations

- 8 Alternatives to Selling Back to a Dealership

- 9 Final Tips for a Smooth Trade-In Experience

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Can I sell my car to a dealership if I still owe money on it?

- 11.2 Will a dealership buy my car if it has mechanical problems?

- 11.3 How long does the trade-in process take?

- 11.4 Can I trade in a leased car?

- 11.5 Do all dealerships accept trade-ins?

- 11.6 Is it better to trade in during a sale or promotion?

Key Takeaways

- Dealerships commonly accept trade-ins: Most car dealers allow you to sell back your vehicle when purchasing a new or used car, using the value as a down payment.

- Trade-in value vs. private sale: You’ll typically get less money trading in your car than selling it privately, but the process is faster and more convenient.

- Vehicle condition matters: Clean interiors, minimal damage, and regular maintenance records can significantly increase your trade-in offer.

- Timing affects value: Market demand, seasonality, and inventory levels influence how much a dealer will pay for your car.

- Negotiate separately: Always negotiate the trade-in value and the price of your new car separately to avoid confusion and get better deals.

- Get multiple appraisals: Visit several dealerships or use online tools like Kelley Blue Book or Edmunds to compare offers before committing.

- Understand taxes and incentives: In many states, trading in reduces the taxable amount on your new car purchase, which can save you hundreds.

📑 Table of Contents

- Can You Sell Back Your Car to the Dealership?

- How Does Selling Your Car to a Dealership Work?

- What Affects Your Car’s Trade-In Value?

- How to Get the Best Offer When Selling Back Your Car

- Tax Benefits and Financial Considerations

- Alternatives to Selling Back to a Dealership

- Final Tips for a Smooth Trade-In Experience

- Conclusion

Can You Sell Back Your Car to the Dealership?

So, you’ve been driving your car for a few years, and now you’re thinking about upgrading. Maybe you need more space, better fuel efficiency, or just want something newer and shinier. But what do you do with your current vehicle? One of the most common questions car owners ask is: *Can you sell back your car to the dealership?*

The short answer is yes—most dealerships are happy to take your car off your hands. Whether you’re buying a new vehicle or just looking to offload your old one, selling back to a dealer is a real option. But it’s not always the most profitable one. While the process is convenient, understanding how dealerships value cars, what affects your offer, and how to negotiate can make a big difference in how much money ends up in your pocket.

In this guide, we’ll walk you through everything you need to know about selling your car back to a dealership. From how trade-ins work to tips for getting the best deal, we’ll cover the ins and outs so you can make a smart, informed decision. Whether you’re trading in a sedan, SUV, or even a truck, this information will help you navigate the process with confidence.

How Does Selling Your Car to a Dealership Work?

When you sell back your car to a dealership, you’re essentially trading it in—either toward the purchase of a new vehicle or, in some cases, for cash. The process is straightforward, but there are a few key steps involved.

First, you’ll need to bring your car to the dealership for an appraisal. A trained appraiser will inspect the vehicle, checking its exterior, interior, mechanical condition, mileage, and overall market value. They’ll also look at service records, accident history, and any modifications. Based on this evaluation, the dealer will make you an offer.

If you’re buying a new car, the trade-in value is usually applied as a down payment, reducing the amount you need to finance. For example, if your new car costs $30,000 and your trade-in is valued at $12,000, you’ll only need to finance $18,000 (before taxes and fees). Some dealerships may also offer cash for your car if you’re not purchasing another vehicle, though this is less common.

It’s important to note that dealerships don’t pay full market value. They need to make a profit when they resell your car, either on their used lot or at auction. That means they’ll typically offer less than what you might get from a private sale. However, the trade-off is convenience—no need to list your car online, meet with strangers, or handle paperwork on your own.

The Appraisal Process

The appraisal is the heart of the trade-in process. Dealers use a combination of tools and experience to determine your car’s worth. They’ll likely reference pricing guides like Kelley Blue Book (KBB), Edmunds, or NADA Guides, but they’ll also consider local market conditions.

During the appraisal, the dealer will:

– Check the vehicle identification number (VIN) for accident history and title status.

– Inspect the exterior for dents, scratches, rust, or paint damage.

– Look inside for stains, tears, odors, or excessive wear.

– Test drive the car to assess engine performance, transmission, brakes, and suspension.

– Review maintenance records and service history.

Even small issues—like a cracked windshield or a malfunctioning radio—can lower the offer. That’s why it’s smart to clean your car thoroughly and fix minor problems before the appraisal.

Trade-In vs. Private Sale: Which Is Better?

One of the biggest decisions you’ll face is whether to trade in your car or sell it privately. Let’s break down the pros and cons.

Trading in your car at a dealership is fast and easy. You drive in, get an offer, and walk out with a new car—all in one visit. There’s no need to create ads, respond to inquiries, or meet potential buyers. Plus, in many states, the trade-in value reduces the taxable amount on your new purchase. For example, if you buy a $35,000 car and trade in a $10,000 vehicle, you only pay sales tax on $25,000.

However, private sales usually yield more money. Since you’re cutting out the middleman, you can price your car closer to its true market value. On average, private sellers earn 10% to 20% more than trade-in offers. The downside? It takes time, effort, and a bit of marketing know-how.

So, which should you choose? If you value convenience and want to simplify the car-buying process, a trade-in makes sense. But if you’re willing to put in the work and want to maximize your return, selling privately is the better route.

What Affects Your Car’s Trade-In Value?

Not all cars are valued equally at the dealership. Several factors influence how much you’ll get when you sell back your vehicle. Understanding these can help you prepare and even increase your offer.

Mileage and Age

Mileage is one of the biggest factors. The more miles your car has, the lower its value. Most buyers prefer lower-mileage vehicles because they’re expected to last longer and require fewer repairs. As a rule of thumb, cars with under 12,000 miles per year are considered low-mileage.

Age also plays a role. Newer cars (under 5 years old) tend to hold their value better, especially if they’re still under warranty. Older vehicles, even with low mileage, may depreciate faster due to outdated technology or styling.

Vehicle Condition

A clean, well-maintained car will always fetch a higher price. Dealers look for signs of regular care—like oil changes, tire rotations, and brake inspections. A full service history can boost your offer.

Exterior and interior condition matter too. Deep scratches, dents, or rust can lower the value, as can stained seats, broken buttons, or bad odors. Even small things like a missing cup holder or a cracked dashboard can be red flags.

Market Demand

The used car market is constantly changing. If your car is in high demand—like a fuel-efficient compact during a gas price spike—you may get a better offer. Conversely, if the market is flooded with similar models, the value drops.

For example, SUVs and trucks often hold their value well due to consistent demand. Luxury cars, on the other hand, can depreciate quickly once they’re out of warranty.

Accident and Title History

A clean title is essential. Cars with salvage, rebuilt, or flood titles are much harder to sell and will receive lower offers—if any at all. Even minor accidents can affect value if they weren’t properly repaired.

Always disclose any past damage honestly. Dealers run vehicle history reports (like Carfax or AutoCheck), so they’ll find out anyway. Being upfront builds trust and can lead to a fairer appraisal.

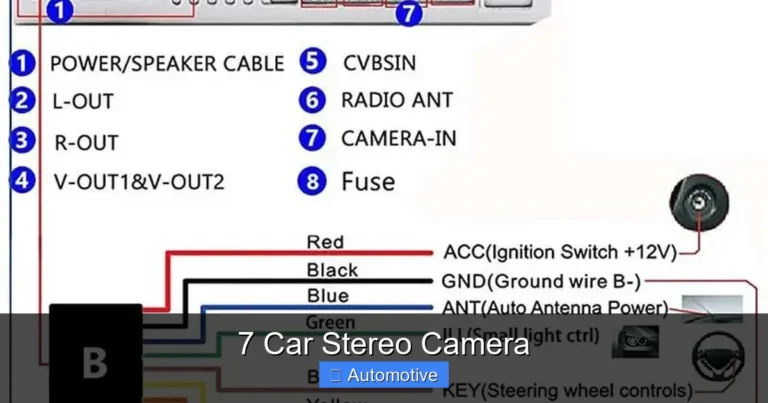

Modifications and Customizations

Aftermarket upgrades—like custom wheels, stereo systems, or performance parts—can be a double-edged sword. While they might appeal to some buyers, most dealers see them as added risk. They may not know how well the modifications were installed or if they’ve caused other issues.

In most cases, modifications reduce trade-in value. If you’ve made changes, consider removing them before the appraisal to get a higher offer.

How to Get the Best Offer When Selling Back Your Car

You don’t have to accept the first offer a dealer gives you. With a little preparation and strategy, you can negotiate a better deal.

Do Your Research

Before visiting any dealership, research your car’s value. Use tools like Kelley Blue Book, Edmunds, or NADA Guides to get a range of what your vehicle is worth in “good” condition. Print out or screenshot these estimates to show the dealer.

Knowing the market value gives you leverage. If the dealer offers significantly less, you can politely point out that your car is priced fairly based on comparable listings.

Clean and Detail Your Car

First impressions matter. A clean car looks well-cared-for and can increase your offer. At minimum, wash the exterior, vacuum the interior, and wipe down surfaces. For best results, consider a professional detailing service.

Don’t forget the small things: clean the dashboard, remove personal items, and air out any odors. A fresh-smelling, spotless car sends the message that it’s been maintained.

Fix Minor Issues

You don’t need to spend thousands on repairs, but addressing small problems can pay off. Replace burnt-out bulbs, fix cracked windshields, and patch up torn upholstery. Even something as simple as replacing worn wiper blades shows attention to detail.

Keep receipts for any repairs—they can be used to justify a higher offer.

Get Multiple Appraisals

Don’t settle for the first offer. Visit at least two or three dealerships to get competing appraisals. Each dealer may value your car differently based on their inventory needs and market strategy.

For example, a dealership with a shortage of used SUVs might offer more for your crossover than one that’s fully stocked. Use these offers as leverage when negotiating.

Negotiate Separately

One of the biggest mistakes people make is combining the trade-in value with the price of the new car. Dealers may offer a “great deal” that sounds good overall but actually undervalues your trade-in.

Always negotiate the trade-in value first. Once you’ve agreed on a fair price for your car, then discuss the price of the new vehicle. This keeps the process transparent and helps you avoid confusion.

Be Ready to Walk Away

If the offer isn’t fair, don’t be afraid to say no. You’re under no obligation to accept. Walking away shows the dealer you’re serious and may prompt them to improve their offer.

Remember, you have other options—like selling privately or using online car-buying services (e.g., CarMax, Carvana, or Vroom). These platforms often provide competitive quotes and can be a good alternative.

Tax Benefits and Financial Considerations

One often-overlooked advantage of trading in your car is the tax benefit. In most states, the trade-in value reduces the taxable amount on your new vehicle purchase.

For example, let’s say you’re buying a $40,000 car and trading in a vehicle worth $15,000. Instead of paying sales tax on the full $40,000, you only pay tax on $25,000. If your sales tax rate is 7%, that’s a savings of $1,050 ($40,000 × 7% = $2,800 vs. $25,000 × 7% = $1,750).

This can make a big difference, especially on higher-priced vehicles. Be sure to ask your dealer about tax savings—they should explain how it works in your state.

Financing and Loan Payoff

If you still owe money on your car, the dealership can handle the payoff as part of the trade-in process. They’ll contact your lender and apply the trade-in value toward the remaining balance.

If your car is worth more than you owe (you’re “upside down”), the equity can be rolled into your new loan. However, if you owe more than the car is worth (you’re “underwater”), you’ll need to pay the difference out of pocket or finance it with your new loan.

Being underwater isn’t the end of the world, but it’s something to be aware of. Try to pay down your loan before trading in, or consider keeping your car longer until the equity improves.

Alternatives to Selling Back to a Dealership

While dealerships are convenient, they’re not your only option. Here are a few alternatives to consider:

Online Car-Buying Services

Companies like CarMax, Carvana, and Vroom offer instant online quotes and will buy your car directly—no trade-in required. You can complete the entire process from home, and they often provide competitive offers.

These services are great if you want a quick sale without the hassle of private listings. However, their offers may still be lower than what you’d get from a private buyer.

Selling Privately

Selling your car yourself on platforms like Craigslist, Facebook Marketplace, or Autotrader can yield the highest return. You set the price, control the negotiation, and keep all the profits.

The downside? It takes time and effort. You’ll need to create ads, respond to messages, schedule test drives, and handle paperwork. But if you’re patient and detail-oriented, it can be worth it.

Auctions and Wholesale Buyers

If your car is older or in poor condition, you might consider selling it at auction or to a wholesale buyer. These options are less common but can be useful for vehicles that aren’t suitable for retail sale.

Just be aware that auction prices are often low, and wholesale buyers typically offer far below market value.

Final Tips for a Smooth Trade-In Experience

Selling back your car to a dealership doesn’t have to be stressful. With the right approach, it can be a smooth and rewarding experience.

– **Gather your documents:** Bring your title, registration, service records, and any warranties. Having everything ready speeds up the process.

– **Be honest about condition:** Don’t hide problems or exaggerate your car’s value. Honesty builds trust and leads to fairer offers.

– **Know your bottom line:** Decide in advance the minimum amount you’re willing to accept. This helps you stay firm during negotiations.

– **Ask questions:** If something isn’t clear—like how the offer was calculated or what fees are included—ask for clarification.

– **Take your time:** Don’t feel pressured to decide on the spot. You can always take the offer home and think it over.

Remember, the goal is to get a fair deal that works for you. Whether you choose to trade in, sell privately, or use an online service, being informed is your best advantage.

Conclusion

So, can you sell back your car to the dealership? Absolutely. It’s a common, convenient option that millions of drivers use every year. While you may not get top dollar compared to a private sale, the ease, speed, and potential tax savings make it a smart choice for many.

The key is to go in prepared. Research your car’s value, clean it up, fix minor issues, and get multiple appraisals. Negotiate the trade-in separately from the new car price, and don’t be afraid to walk away if the offer isn’t fair.

Whether you’re upgrading to a new ride or just ready for a change, selling your car back to a dealership can be a great way to simplify the process. With the right strategy, you’ll drive off the lot feeling confident—and maybe even a little richer.

Frequently Asked Questions

Can I sell my car to a dealership if I still owe money on it?

Yes, you can still sell back your car to a dealership even if you have an outstanding loan. The dealer will pay off your lender and apply any remaining equity toward your new purchase. If you owe more than the car is worth, you’ll need to cover the difference.

Will a dealership buy my car if it has mechanical problems?

Most dealerships will still consider your car, even with mechanical issues, but the offer will be significantly lower. They may sell it for parts or at auction. Be honest about the problems to avoid complications later.

How long does the trade-in process take?

The appraisal and paperwork typically take 30 minutes to an hour. If you’re buying a new car, the entire process—including financing and delivery—can take a few hours, depending on the dealership’s workload.

Can I trade in a leased car?

Yes, you can trade in a leased vehicle, but you’ll need to contact your leasing company first. They may allow early termination or transfer the lease to the new buyer. Any equity or fees will be handled during the transaction.

Do all dealerships accept trade-ins?

Most franchised dealerships accept trade-ins, especially when you’re buying another vehicle. However, some independent or specialty dealers may not. It’s best to call ahead and confirm their policy.

Is it better to trade in during a sale or promotion?

Timing can help. Dealerships may offer higher trade-in values during slow sales periods or special promotions to move inventory. Keep an eye on seasonal trends—like end-of-year clearance events—for better deals.