Can I Sell My Car Without Insurance

You can legally sell your car without having active insurance on it, but only under specific conditions. Most states require insurance to operate a vehicle on public roads, but not necessarily to transfer ownership—especially if the car won’t be driven after the sale. However, you must ensure the vehicle is properly titled, inspected (if required), and that liability is clearly transferred to avoid future legal or financial issues.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can I Sell My Car Without Insurance? A Complete Guide

- 4 Understanding the Legal Requirements by State

- 5 When You Can (and Should) Drop Insurance Before Selling

- 6 What the Buyer Needs to Know About Insurance

- 7 Protecting Yourself from Liability After the Sale

- 8 Practical Tips for a Smooth Sale

- 9 Common Mistakes to Avoid

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Can I sell my car if it’s not insured?

- 11.2 Do I need to keep my insurance active until the sale is complete?

- 11.3 What happens if I cancel my insurance before selling the car?

- 11.4 Does the buyer need insurance before driving the car home?

- 11.5 Can I sell a car that’s been declared a total loss?

- 11.6 What documents do I need to sell my car without insurance?

Key Takeaways

- Insurance is not legally required to sell a car in most states: You don’t need active coverage to transfer ownership, but you must comply with state-specific rules.

- The buyer typically needs insurance before driving the car: Once the sale is complete, the new owner must insure the vehicle before operating it on public roads.

- Canceling your insurance too early can be risky: Keep coverage active until the sale is finalized to avoid gaps in protection or penalties.

- Non-operational vehicles may qualify for storage insurance: If the car won’t be driven, consider switching to a minimal storage policy instead of full coverage.

- Document the sale thoroughly: Use a bill of sale, title transfer, and release of liability form to protect yourself from future claims.

- Some states require emissions or safety inspections: These may need to be completed before the sale, regardless of insurance status.

- Selling a car “as-is” doesn’t remove your responsibility: You’re still liable for any issues that arise before the transfer is complete.

📑 Table of Contents

- Can I Sell My Car Without Insurance? A Complete Guide

- Understanding the Legal Requirements by State

- When You Can (and Should) Drop Insurance Before Selling

- What the Buyer Needs to Know About Insurance

- Protecting Yourself from Liability After the Sale

- Practical Tips for a Smooth Sale

- Common Mistakes to Avoid

- Conclusion

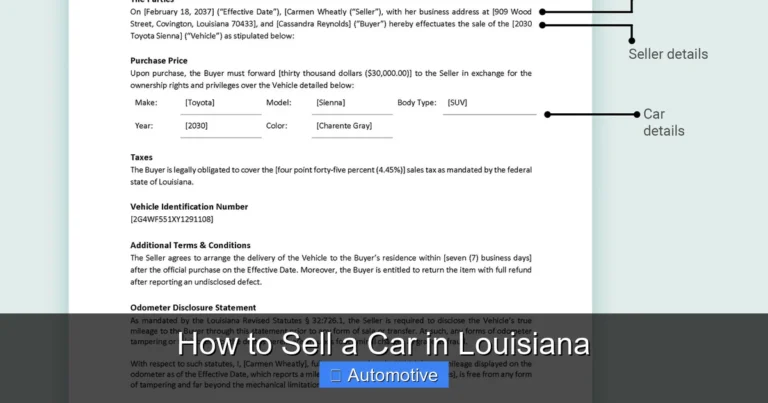

Can I Sell My Car Without Insurance? A Complete Guide

So, you’ve decided it’s time to part ways with your car. Maybe you’re upgrading to a newer model, switching to public transit, or simply don’t need a vehicle anymore. As you start the selling process, one question pops up: *Do I need to keep my car insured while selling it?* It’s a smart question—and the answer isn’t always straightforward.

The short version? Yes, you can sell your car without active insurance—but only if you follow the right steps and understand your state’s laws. While most states don’t require you to have insurance to transfer ownership, they *do* require it to drive the vehicle on public roads. That means if your car is parked in your driveway and not being driven, you might be able to drop coverage temporarily. But if you’re still using it to get around, you absolutely need to keep your policy active.

This guide will walk you through everything you need to know about selling a car without insurance—legally, safely, and without unnecessary stress. We’ll cover state-specific rules, timing your insurance cancellation, protecting yourself from liability, and what the buyer needs to do. By the end, you’ll feel confident handling the sale, whether you’re listing it online, trading it in, or selling it privately.

Understanding the Legal Requirements by State

One of the biggest misconceptions about selling a car is that insurance is always required. In reality, the rules vary significantly from state to state. While every state mandates liability insurance for drivers operating vehicles on public roads, very few require you to have insurance simply to *own* or *sell* a car—especially if it’s not being driven.

For example, in states like California, Texas, and Florida, you can legally sell a car without active insurance as long as the vehicle is not being operated. However, you must still complete a title transfer and notify the DMV of the sale. In contrast, some states—like New York—require proof of insurance even for vehicle registration transfers, which can complicate things if you’re trying to sell before canceling your policy.

States Where Insurance Is Not Required to Sell

In most states, including Arizona, Georgia, Illinois, and Ohio, you can sell your car without insurance, provided the vehicle is not driven after the sale. These states focus on insurance requirements for *operation*, not ownership. So if your car is parked and not being used, you’re generally in the clear.

However, you still need to follow proper procedures. This includes signing over the title, completing a bill of sale, and submitting a release of liability form to your state’s DMV. Failing to do so could leave you on the hook for tickets, accidents, or toll violations that occur after the sale—even if you no longer own the car.

States with Stricter Rules

A handful of states have more stringent requirements. In New Jersey, for instance, you must maintain insurance until the vehicle is officially deregistered. Similarly, in Massachusetts, you can’t cancel your insurance until the title is transferred and the car is no longer in your name. These rules are designed to prevent gaps in coverage and protect public safety.

If you live in one of these states, it’s best to keep your insurance active until the sale is fully complete—title signed, money exchanged, and the buyer has taken possession. Then, and only then, should you contact your insurer to cancel or adjust your policy.

How to Check Your State’s Specific Laws

The easiest way to find out what’s required in your area is to visit your state’s Department of Motor Vehicles (DMV) website. Look for sections on “selling a vehicle,” “title transfer,” or “insurance requirements.” Many DMV sites also offer downloadable forms and step-by-step guides.

You can also call your local DMV office or speak with an insurance agent. They’ll be able to clarify whether you need to maintain coverage during the sale process and what documentation is necessary to protect yourself.

When You Can (and Should) Drop Insurance Before Selling

Now that you know the legal landscape, let’s talk timing. When is it safe—and smart—to cancel your car insurance before selling?

The general rule is: **Only drop coverage after the sale is complete and the car is no longer in your possession.** Here’s why.

The Risks of Canceling Too Early

If you cancel your insurance before finalizing the sale, you leave yourself exposed. What if the buyer backs out at the last minute? What if there’s a delay in paperwork? Or worse—what if someone damages the car while it’s still in your driveway and you’re uninsured?

Even if the car isn’t being driven, it’s still at risk of theft, vandalism, or weather damage. Without comprehensive coverage, you’re on the hook for repairs or replacement. And if the car is still registered in your name, you could face penalties for driving without insurance—even if you’re not the one driving.

When It’s Safe to Cancel

The safest time to cancel your insurance is **after**:

– The buyer has paid in full.

– The title has been signed over.

– The car has been removed from your property.

– You’ve submitted a release of liability to the DMV.

At that point, the vehicle is no longer your responsibility, and you can confidently contact your insurer to end your policy. Most companies allow you to cancel over the phone or online, and they’ll prorate your refund for any unused premium.

Consider Switching to Storage Insurance

If you’re not ready to sell immediately but want to reduce costs, consider switching to a storage or “lay-up” insurance policy. This type of coverage is designed for vehicles that are parked and not being driven. It typically includes comprehensive coverage (for theft, fire, hail, etc.) but excludes collision and liability—since the car isn’t on the road.

Storage insurance is much cheaper than full coverage and can save you money while you prepare to sell. Just make sure the policy allows for occasional starts or moves—some insurers require the car to be stored in a locked garage.

What the Buyer Needs to Know About Insurance

While you don’t need insurance to sell your car, the buyer definitely does—especially if they plan to drive it home. Here’s what you should communicate to potential buyers to ensure a smooth transfer.

The Buyer Must Insure the Car Before Driving

In every state, the new owner is required to have insurance before operating the vehicle on public roads. This means they’ll need to secure a policy—either by adding the car to an existing policy or purchasing a new one—before they can legally drive it away.

As the seller, you can help by providing key details like the VIN, make, model, year, and mileage. This makes it easier for the buyer to get an accurate quote and activate coverage quickly.

Can the Buyer Drive the Car Home Without Insurance?

This is a common question—and the answer is almost always **no**. Even if the buyer has insurance on another vehicle, they cannot legally drive an uninsured car on public roads. Some buyers may ask to use your insurance temporarily, but this is risky and often not allowed by insurers.

Instead, suggest that the buyer:

– Arrange for insurance before the sale.

– Use a trailer or tow service to transport the car.

– Meet at a location close to their home or an insurance office.

Helping the Buyer Get Insured

You can make the process easier by being transparent about the car’s condition and history. Provide maintenance records, a recent inspection (if applicable), and any known issues. This helps the buyer get accurate coverage and avoids surprises later.

If the car is older or has high mileage, the buyer may need to shop around for specialized insurance. Encourage them to compare quotes from multiple providers to find the best rate.

Protecting Yourself from Liability After the Sale

One of the most important parts of selling a car—with or without insurance—is protecting yourself from future liability. Just because you’ve handed over the keys doesn’t mean you’re off the hook.

Complete a Bill of Sale

A bill of sale is a legal document that proves the transaction took place. It should include:

– Names and addresses of buyer and seller

– Vehicle description (make, model, year, VIN)

– Sale price

– Date of sale

– Odometer reading

– Signatures of both parties

Many states provide free templates online. Keep a copy for your records.

Sign Over the Title Correctly

The title transfer is the most critical step. Make sure to:

– Fill out the seller section completely.

– Sign in the presence of a notary if required (in some states).

– Provide the buyer with a copy.

Never leave blank spaces on the title—this can lead to fraud.

Submit a Release of Liability

This form tells the DMV that you’re no longer responsible for the vehicle. It’s usually submitted online or by mail and should be done within a few days of the sale. Once filed, you’re protected from tickets, accidents, or toll violations that occur after the transfer.

Notify Your Insurance Company

Even if you’ve canceled your policy, inform your insurer that the car has been sold. This creates a paper trail and ensures there’s no confusion if a claim is filed later.

Practical Tips for a Smooth Sale

Selling a car without insurance doesn’t have to be complicated. Follow these tips to make the process stress-free.

Prepare the Car for Sale

– Clean it inside and out.

– Fix minor issues (e.g., burnt-out bulbs, low tire pressure).

– Gather all keys, manuals, and service records.

Set a Fair Price

Use tools like Kelley Blue Book or Edmunds to determine a competitive price. Be honest about the car’s condition.

Advertise Effectively

List the car on trusted platforms like Craigslist, Facebook Marketplace, or Autotrader. Include clear photos and a detailed description.

Meet Safely

Meet in a public place during daylight hours. Bring a friend if possible. Accept secure payment methods like cash, cashier’s check, or bank transfer.

Finalize the Sale Quickly

Once the buyer is ready, complete the transaction in one session. Sign the title, exchange money, and hand over the keys. Then, immediately submit your release of liability.

Common Mistakes to Avoid

Even experienced sellers make errors. Here are some pitfalls to watch out for.

Canceling Insurance Too Soon

As mentioned earlier, dropping coverage before the sale is complete is risky. Wait until the car is gone and the paperwork is filed.

Not Keeping Records

Save copies of the bill of sale, title, and release of liability. You may need them if a dispute arises.

Ignoring State Requirements

Don’t assume all states have the same rules. Double-check your DMV’s guidelines.

Selling to an Unverified Buyer

Be cautious of buyers who refuse to meet in person or ask for unusual payment methods. Scams are common in private car sales.

Conclusion

Selling your car without insurance is not only possible—it’s often the smart financial move, especially if the vehicle won’t be driven after the sale. However, it’s crucial to understand your state’s laws, time your insurance cancellation correctly, and protect yourself with proper documentation.

By following the steps outlined in this guide—completing a bill of sale, transferring the title, submitting a release of liability, and communicating clearly with the buyer—you can sell your car safely and legally, even without active coverage. Remember, the goal isn’t just to get rid of the car, but to do it in a way that protects your wallet, your record, and your peace of mind.

Whether you’re upgrading, downsizing, or going car-free, selling your vehicle doesn’t have to be stressful. With the right preparation, you can close the deal confidently and move on to your next chapter.

Frequently Asked Questions

Can I sell my car if it’s not insured?

Yes, you can sell your car without insurance in most states, as long as the vehicle is not being driven. However, you must complete the title transfer and notify the DMV to avoid future liability.

Do I need to keep my insurance active until the sale is complete?

It’s strongly recommended. Keep your insurance active until the buyer takes possession and the title is transferred. This protects you from accidents, theft, or legal issues during the transition.

What happens if I cancel my insurance before selling the car?

You risk being uninsured if the car is damaged, stolen, or involved in an accident while still in your name. You could also face penalties for driving without coverage if you use the car during the sale process.

Does the buyer need insurance before driving the car home?

Yes, the buyer must have active insurance before operating the vehicle on public roads. They cannot legally drive an uninsured car, even for a short distance.

Can I sell a car that’s been declared a total loss?

Yes, but you must disclose its salvage or rebuilt title status to the buyer. Insurance and registration rules may differ for salvage vehicles, so check your state’s requirements.

What documents do I need to sell my car without insurance?

You’ll need the vehicle title, a bill of sale, odometer disclosure, and a release of liability form. Some states also require a smog or safety inspection certificate.