Can a Dealership Sell a Car Without Insurance

Dealerships are legally allowed to sell cars without providing insurance, but you cannot legally drive the vehicle without it. Understanding state laws, dealer responsibilities, and your own obligations ensures a smooth, compliant car-buying experience.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can a Dealership Sell a Car Without Insurance?

- 4 Why Dealerships Don’t Provide Insurance

- 5 State Laws and Insurance Requirements

- 6 What Happens If You Drive Without Insurance?

- 7 How to Secure Insurance Before Buying a Car

- 8 Special Considerations for Financed and Leased Vehicles

- 9 Tips for a Smooth Car-Buying Experience

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Can a dealership sell me a car if I don’t have insurance?

- 11.2 Do I need insurance before buying a car?

- 11.3 What happens if I drive a new car without insurance?

- 11.4 Can I add a new car to my existing insurance policy?

- 11.5 Do financed cars require more than liability insurance?

- 11.6 Is there a grace period for insuring a new car?

Key Takeaways

- Dealerships don’t provide insurance: They sell vehicles, not insurance policies. It’s the buyer’s responsibility to secure coverage.

- You can’t drive without insurance: Most states require proof of insurance before you can legally operate a vehicle on public roads.

- Dealers may offer temporary coverage: Some provide short-term policies or allow you to add the car to an existing policy at the lot.

- State laws vary: Requirements differ by state—some allow a grace period, while others demand immediate coverage.

- Financing often requires full coverage: If you’re taking a loan, lenders typically require comprehensive and collision insurance.

- Uninsured driving risks fines and penalties: Driving without insurance can result in license suspension, fines, or even vehicle impoundment.

- Plan ahead: Contact your insurer before buying to ensure seamless coverage from day one.

📑 Table of Contents

- Can a Dealership Sell a Car Without Insurance?

- Why Dealerships Don’t Provide Insurance

- State Laws and Insurance Requirements

- What Happens If You Drive Without Insurance?

- How to Secure Insurance Before Buying a Car

- Special Considerations for Financed and Leased Vehicles

- Tips for a Smooth Car-Buying Experience

- Conclusion

Can a Dealership Sell a Car Without Insurance?

Buying a car from a dealership is an exciting milestone. The shiny exterior, the new-car smell, the test drive—everything feels perfect. But amid the excitement, one critical detail often gets overlooked: insurance. You might assume the dealership handles it, or that you can drive off the lot and figure it out later. But here’s the truth: **a dealership can absolutely sell you a car without providing insurance**, and in most cases, they do.

That doesn’t mean you’re off the hook. In fact, it’s the opposite. Once you sign the papers and take ownership, the responsibility for insuring the vehicle shifts entirely to you. While dealerships are experts in selling cars, they are not insurance providers. Their job is to transfer ownership, not to cover your liability on the road. So, if you’re planning to drive your new car home, you’d better have insurance lined up—or you could be breaking the law.

This article will walk you through everything you need to know about buying a car from a dealership without insurance, including legal requirements, dealer practices, state-specific rules, and how to protect yourself. Whether you’re a first-time buyer or a seasoned car owner, understanding this process can save you time, money, and legal trouble.

Why Dealerships Don’t Provide Insurance

It might seem logical to assume that a car dealership would include insurance as part of the purchase, especially since they handle financing, registration, and paperwork. But insurance is a separate industry with its own regulations, underwriting processes, and risk assessments. Dealerships are not licensed to sell insurance in most states, and even if they were, it wouldn’t make financial or practical sense.

Dealerships Are Not Insurance Agents

First and foremost, dealerships are in the business of selling vehicles. Their expertise lies in inventory management, sales tactics, financing options, and customer service—not in evaluating risk, setting premiums, or processing claims. While some dealerships may partner with insurance companies or have on-site brokers, they are not authorized to issue policies themselves. That’s the job of licensed insurance agents or direct insurers.

Even when a dealership offers “insurance” at the lot, it’s usually a referral service. They might hand you a brochure or connect you with a partner agency, but the actual policy is issued by a third party. This means the dealership has no control over your coverage, rates, or claims process. They simply facilitate the connection.

Insurance Is a Personal Responsibility

Insurance is tied to the driver and the vehicle, not the seller. When you buy a car, you’re taking on the responsibility of insuring it based on your driving history, location, credit score, and other personal factors. A dealership can’t possibly assess your risk profile or offer a policy that fits your needs. That’s why insurance applications require detailed personal information—something a car salesman isn’t equipped to collect or process.

Additionally, insurance policies are contracts between you and the insurer. The dealership has no legal standing in that agreement. If you get into an accident, the insurance company will deal directly with you, not the dealer. So, while the dealer can help you find coverage, they can’t—and shouldn’t—be responsible for it.

Legal and Financial Liability

If dealerships were required to provide insurance, it would create a massive liability issue. Imagine a scenario where a dealer insures a car, but the policy lapses or doesn’t cover a specific type of damage. Who’s responsible? The buyer? The dealer? The insurer? These gray areas would lead to lawsuits, regulatory headaches, and increased costs for everyone.

By keeping insurance separate, the system remains clear: the buyer is responsible for coverage. This protects both the dealership and the consumer. It also encourages buyers to shop around for the best rates and coverage, rather than accepting a one-size-fits-all policy from the dealer.

State Laws and Insurance Requirements

One of the most important things to understand is that **insurance laws vary significantly from state to state**. While all states except New Hampshire require some form of auto insurance, the specifics—such as minimum coverage, grace periods, and enforcement—differ widely. This means your experience buying a car without insurance could be very different depending on where you live.

Minimum Coverage Requirements

Most states require drivers to carry liability insurance, which covers damages or injuries you cause to others in an accident. The minimum amounts vary. For example:

– California requires 15/30/5 (meaning $15,000 for bodily injury per person, $30,000 per accident, and $5,000 for property damage).

– Texas requires 30/60/25.

– Florida requires only $10,000 in property damage liability and $10,000 in personal injury protection (PIP), but no bodily injury liability.

These minimums are often insufficient to cover serious accidents, which is why experts recommend higher limits or additional coverage like collision and comprehensive. But legally, as long as you meet the state minimum, you’re compliant.

Grace Periods for New Purchases

Some states offer a grace period that allows you to drive a newly purchased vehicle without immediate insurance. For example:

– In New York, you have 30 days to insure a new car.

– In Illinois, the grace period is 20 days.

– In Arizona, you must have insurance before driving off the lot—no exceptions.

During a grace period, you can typically add the new vehicle to your existing policy or purchase a new one. However, this doesn’t mean you’re off the hook. If you’re pulled over or involved in an accident during this time and don’t have proof of insurance, you could still face penalties.

It’s also important to note that grace periods usually apply only to vehicles purchased from licensed dealers. If you buy a car privately, the rules may be stricter.

Proof of Insurance at the Dealership

Even if your state allows a grace period, most dealerships will require proof of insurance before you can take possession of the vehicle. This is especially true if you’re financing the car. Lenders want to protect their investment, so they’ll insist on full coverage (comprehensive and collision) from day one.

At the very least, you’ll need to show proof of liability insurance. This can be a digital copy on your phone, a printed insurance card, or a temporary policy issued by your insurer. Some dealerships may even verify the policy with the insurance company before releasing the car.

If you don’t have insurance, the dealer may refuse to let you drive the car home. In some cases, they might offer to deliver it to your home or arrange for a tow—but that’s not guaranteed. It’s always better to come prepared.

What Happens If You Drive Without Insurance?

Driving without insurance is not just risky—it’s illegal in most places. The consequences can be severe, ranging from fines and license suspension to vehicle impoundment and even jail time in extreme cases.

Fines and Penalties

If you’re caught driving without insurance, you’ll likely face a fine. The amount varies by state but can range from $100 to over $1,000. For example:

– In California, first-time offenders face a fine of $100–$200.

– In Texas, fines start at $175 and can go up to $350 for repeat offenses.

– In New York, fines can exceed $1,500, plus a driver’s license suspension.

These fines are in addition to any costs related to an accident. If you cause damage or injury and don’t have insurance, you could be personally liable for thousands—or even millions—of dollars in damages.

License and Registration Suspension

Many states will suspend your driver’s license and vehicle registration if you’re caught driving uninsured. In some cases, you’ll need to pay a reinstatement fee and provide proof of insurance (often through an SR-22 form) to get your license back.

For example, in Florida, driving without insurance can result in a 12-month license suspension and a $500 fine. In Ohio, first-time offenders face a 90-day suspension and a $100 reinstatement fee.

Vehicle Impoundment

In some states, law enforcement can impound your vehicle if you’re caught driving without insurance. This means your car will be towed and stored at a impound lot until you pay towing fees, storage fees, and provide proof of insurance. These costs can add up quickly—sometimes exceeding $1,000.

Increased Insurance Rates

Even if you avoid legal trouble, driving without insurance can hurt your future insurance rates. Insurers view uninsured drivers as high-risk, which can lead to significantly higher premiums when you finally do get coverage. In some cases, you may be forced to buy insurance through a high-risk pool, which is even more expensive.

How to Secure Insurance Before Buying a Car

The best way to avoid these risks is to secure insurance before you even step foot on the dealership lot. Here’s how to do it smoothly and affordably.

Contact Your Current Insurer

If you already have auto insurance, call your provider before buying a new car. Most insurers allow you to add a new vehicle to your existing policy, often with a temporary coverage period (usually 14–30 days). This gives you time to shop around for better rates or adjust your coverage.

Be prepared to provide the VIN (Vehicle Identification Number), make, model, and year of the car you’re buying. Your insurer will calculate the new premium and issue a temporary insurance card, which you can show at the dealership.

Shop Around for New Quotes

If you don’t have insurance or want to compare rates, get quotes from multiple insurers. Use online comparison tools or contact agents directly. Be honest about your driving history, credit score, and coverage needs.

Some insurers offer “new car” discounts or bundle deals if you also have home or renters insurance. Don’t forget to ask about these savings.

Consider Temporary or Short-Term Policies

In a pinch, some insurers offer short-term or temporary policies that last 7–30 days. These are ideal if you need immediate coverage but want time to compare long-term options. Just make sure the policy meets your state’s minimum requirements.

Use Digital Insurance Cards

Most insurers now offer digital insurance cards that you can access on your smartphone. These are legally accepted in all 50 states and are perfect for showing proof at the dealership. Just make sure your phone is charged and the app is working before you go.

Ask the Dealership for Help

While dealers can’t sell you insurance, many have relationships with local agents or online services. They may be able to connect you with a broker who can issue a policy on the spot. This can be a lifesaver if you forgot to arrange coverage in advance.

Just remember: the dealer is not responsible if the policy doesn’t meet your needs or if there’s a delay in processing. Always verify the details yourself.

Special Considerations for Financed and Leased Vehicles

If you’re financing or leasing your car, the rules are even stricter. Lenders and leasing companies have a financial stake in the vehicle, so they require more than just liability insurance.

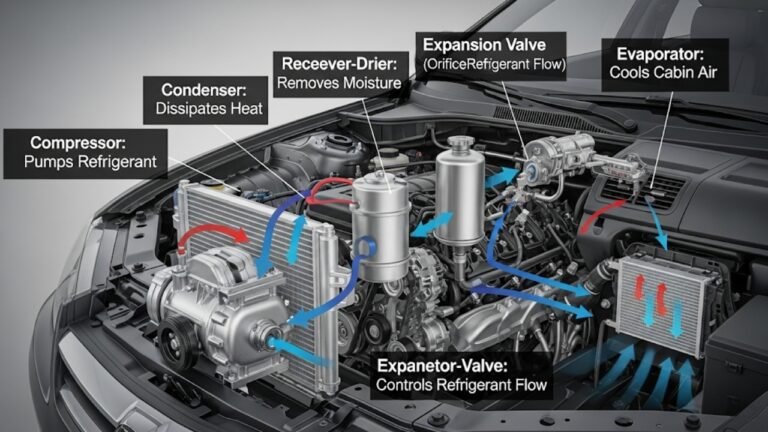

Full Coverage Is Usually Required

Most lenders require comprehensive and collision coverage, which protects the vehicle itself from damage (not just third parties). This means your policy must cover theft, vandalism, weather damage, and accidents—even if you’re not at fault.

The coverage amount must be at least equal to the loan or lease value of the car. If the car is totaled, the insurance payout should cover what you owe.

Gap Insurance May Be Needed

If you’re financing a new car, consider gap insurance. This covers the difference between what you owe on the loan and the car’s actual cash value if it’s totaled or stolen. Since new cars depreciate quickly, this gap can be significant.

Some lenders require gap insurance, especially for long-term loans or low down payments. It’s usually inexpensive and can save you thousands.

Lease Agreements Often Include Insurance Requirements

Leasing companies typically have detailed insurance requirements, including higher liability limits and specific coverage types. They may also require you to list them as a “loss payee” on the policy, meaning they get paid directly if there’s a claim.

Always read your lease agreement carefully and confirm your insurance meets all requirements before signing.

Tips for a Smooth Car-Buying Experience

Buying a car is a big decision, and insurance is a crucial part of the process. Here are some practical tips to make it easier:

– **Plan ahead:** Don’t wait until the day of purchase to think about insurance. Start shopping at least a week in advance.

– **Bring proof:** Have your insurance card (digital or printed) ready when you arrive at the dealership.

– **Know your state’s laws:** Research your state’s minimum coverage and grace period rules.

– **Ask questions:** If you’re unsure about anything, ask the dealer or your insurer for clarification.

– **Don’t skip coverage:** Even if you think you can drive without insurance, the risks far outweigh the savings.

Conclusion

So, can a dealership sell a car without insurance? The answer is a clear yes—and they do it every day. But that doesn’t mean you can drive away without coverage. Insurance is your responsibility, and failing to secure it can lead to serious legal and financial consequences.

By understanding the rules, planning ahead, and working with your insurer, you can ensure a smooth, compliant car-buying experience. Remember: the dealership sells the car, but you’re responsible for protecting it—and everyone on the road.

Whether you’re buying your first car or upgrading to a newer model, don’t let insurance be an afterthought. Treat it as a critical part of the purchase process, and you’ll drive off the lot with confidence, not worry.

Frequently Asked Questions

Can a dealership sell me a car if I don’t have insurance?

Yes, a dealership can legally sell you a car without insurance. However, they may not allow you to drive it off the lot without proof of coverage, depending on state laws and their policies.

Do I need insurance before buying a car?

While you don’t need insurance to purchase a car, you do need it to legally drive it. Most states require proof of insurance before you can operate a vehicle on public roads.

What happens if I drive a new car without insurance?

You could face fines, license suspension, vehicle impoundment, and personal liability for damages. It’s illegal in most states and highly risky.

Can I add a new car to my existing insurance policy?

Yes, most insurers allow you to add a new vehicle to your current policy, often with temporary coverage for 14–30 days while you finalize your plan.

Do financed cars require more than liability insurance?

Yes, lenders typically require comprehensive and collision coverage to protect their investment. Gap insurance may also be recommended.

Is there a grace period for insuring a new car?

Some states offer a grace period (e.g., 20–30 days), but this varies. Always check your state’s laws and confirm with your insurer.