Sell Junk Car with Lien

Selling a junk car with a lien doesn’t have to be complicated. With the right steps, you can clear the loan, transfer ownership, and walk away with cash—even if your vehicle is damaged or non-running.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can You Really Sell a Junk Car with a Lien?

- 4 Understanding Liens: What They Are and Why They Matter

- 5 Step-by-Step Guide to Selling a Junk Car with a Lien

- 6 Working with Cash-for-Cars Companies: What to Look For

- 7 Common Mistakes to Avoid When Selling a Junk Car with a Lien

- 8 What If You Owe More Than the Car Is Worth?

- 9 Legal and Financial Considerations

- 10 Final Tips for a Smooth Sale

- 11 Frequently Asked Questions

- 11.1 Can I sell my junk car if I still owe money on it?

- 11.2 Do I need the title to sell a junk car with a lien?

- 11.3 What happens if I sell my car without clearing the lien?

- 11.4 How long does it take to release a lien after payment?

- 11.5 Can a junk car buyer pay my lender directly?

- 11.6 What if my car is worth less than what I owe?

Key Takeaways

- Understand what a lien means: A lienholder (usually a bank or lender) has a legal claim on your car until the loan is paid off. You can’t legally sell the car without resolving this first.

- Contact your lienholder early: Reach out to your lender before listing the car. They’ll guide you on payoff amounts, paperwork, and release procedures.

- Get a payoff quote: Request a 10-day payoff quote from your lender. This tells you exactly how much you owe, including interest and fees.

- Work with cash-for-cars companies: Many buyers specialize in junk cars with liens and can help coordinate payment directly to your lender.

- Complete the title transfer properly: Once the lien is released, ensure the title is signed and transferred correctly to avoid future liability.

- Keep records of everything: Save all communication, receipts, and signed documents for at least 3–5 years after the sale.

- Don’t ignore the lien: Trying to sell without clearing it can lead to legal trouble, fines, or repossession.

📑 Table of Contents

- Can You Really Sell a Junk Car with a Lien?

- Understanding Liens: What They Are and Why They Matter

- Step-by-Step Guide to Selling a Junk Car with a Lien

- Working with Cash-for-Cars Companies: What to Look For

- Common Mistakes to Avoid When Selling a Junk Car with a Lien

- What If You Owe More Than the Car Is Worth?

- Legal and Financial Considerations

- Final Tips for a Smooth Sale

Can You Really Sell a Junk Car with a Lien?

So, your car’s seen better days—maybe it won’t start, has major damage, or just isn’t worth fixing anymore. You’ve decided it’s time to sell it as junk. But there’s one big problem: you still owe money on it. There’s a lien on the title. Does that mean you’re stuck?

Not at all.

Selling a junk car with a lien is absolutely possible—but it requires a bit more planning than selling a paid-off vehicle. The key is understanding how liens work and knowing the right steps to take so you don’t end up in hot water (or worse, owing money after the sale).

A lien is simply a legal claim placed on your vehicle by the lender who financed it. Think of it like a security deposit—they hold onto the title until you’ve paid back the loan in full. Until then, they technically have a stake in the car. That means you can’t just hand over the keys and walk away. But with coordination between you, your lender, and a reputable buyer, you can sell that clunker, settle the debt, and maybe even walk away with some cash in your pocket.

In this guide, we’ll walk you through every step—from contacting your lender to signing over the title—so you can sell your junk car with a lien confidently and legally.

Understanding Liens: What They Are and Why They Matter

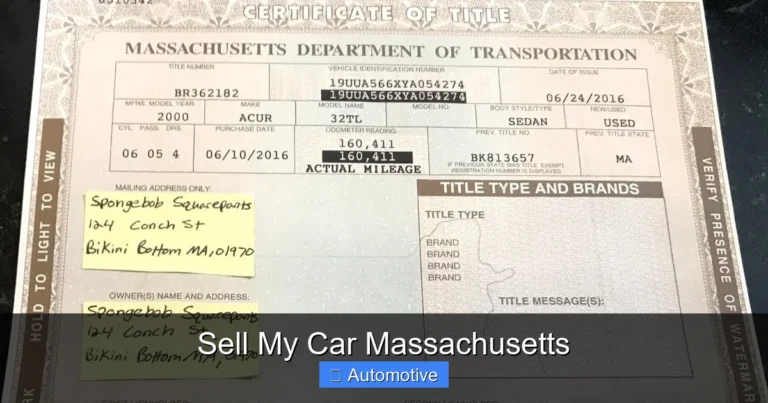

Visual guide about Sell Junk Car with Lien

Image source: cashtodayforjunkcars.com

Before you can sell your junk car, it’s important to understand exactly what a lien is and why it affects your sale.

A lien is a legal right or interest that a lender has in your property—in this case, your car—until a debt (your auto loan) is fully paid. It’s not ownership, but it gives the lender the right to repossess the vehicle if you stop making payments. Most people encounter liens when they finance a car through a bank, credit union, or dealership financing program.

There are two main types of liens:

– Voluntary liens: These are placed when you agree to use your car as collateral for a loan. Almost all auto loans fall into this category.

– Involuntary liens: These are placed without your consent, usually due to unpaid taxes, mechanics’ bills, or court judgments. These are less common but still possible.

When you see “lienholder” on your car title, it means someone else has a legal claim to the vehicle. This prevents you from selling or transferring ownership until the lien is officially released.

Why does this matter when selling a junk car? Because buyers—especially junk car buyers—need a clear title to resell or scrap the vehicle. If the lien isn’t cleared, the new owner could face legal issues, and you could still be held responsible for the debt.

So, while you can’t ignore the lien, you also don’t have to pay off the entire loan out of pocket before selling. With the right approach, the sale proceeds can go directly to the lender, settling the debt and freeing up the title.

How Liens Affect the Sale Process

Having a lien on your junk car doesn’t stop you from selling it—it just changes how the sale happens. Here’s what changes:

– You can’t transfer ownership until the lien is released. The buyer needs a clean title to register or scrap the car.

– The sale proceeds must first go to the lienholder. You can’t pocket the money if it’s owed to the lender.

– Timing is critical. You’ll need to coordinate between the buyer, the lender, and possibly a notary or DMV.

But don’t worry—this process is more common than you think. Many cash-for-cars companies specialize in buying vehicles with outstanding loans. They know how to work with lenders and handle the paperwork so you don’t have to.

Step-by-Step Guide to Selling a Junk Car with a Lien

Visual guide about Sell Junk Car with Lien

Image source: usajunkcarremoval.com

Selling a junk car with a lien might sound complicated, but it’s actually a straightforward process if you follow the right steps. Here’s exactly what you need to do—from start to finish.

Step 1: Contact Your Lienholder

The first and most important step is to call your lender. Whether it’s a bank, credit union, or financing company, you need to let them know you’re planning to sell your car.

Ask for:

– The current payoff amount (including interest and fees)

– A 10-day payoff quote (this locks in the amount for 10 days)

– Instructions on how to release the lien after payment

– Any required forms or documentation

Most lenders will email or mail you a payoff quote within 1–2 business days. This document is essential—it tells you exactly how much money needs to be paid to clear the loan.

Pro tip: Call early in the week to avoid delays. Some lenders take longer on Fridays or near holidays.

Step 2: Get a Realistic Offer from a Junk Car Buyer

Now that you know how much you owe, it’s time to find a buyer. Look for reputable cash-for-cars companies that explicitly state they buy vehicles with liens.

When you contact them, provide:

– The make, model, year, and condition of the car

– The current mileage (if known)

– Whether it runs or not

– The lienholder’s name and payoff amount

Many buyers will give you a free quote over the phone or online. Be honest about the car’s condition—this helps avoid lowball offers later.

Example: Let’s say you have a 2010 Honda Civic that doesn’t start, with $3,200 still owed on the loan. A junk car buyer might offer $1,800. That means $1,800 goes to the lender, and you’re still responsible for the remaining $1,400. But if the car is worth more—say, $4,000—you could walk away with $800 after the loan is paid.

Some buyers may even offer to pay the full payoff amount and give you the difference. It depends on the car’s scrap value, parts, and market demand.

Step 3: Coordinate Payment with the Lienholder

This is where things get a little tricky—but manageable.

Once you accept an offer, the buyer will typically:

– Send a check made out to both you and the lienholder

– Or wire funds directly to the lender (preferred method)

If the check is joint (made out to you and the lender), you’ll need to sign it over to the lender. Some lenders require this to be done in person or with a notary.

If the buyer wires the money directly, they’ll need the lender’s payment instructions. You’ll provide these from your payoff quote.

Important: Never accept a check made only to you if the lienholder requires joint payment. This could delay the process or cause the lender to reject the funds.

Step 4: Wait for the Lien Release

After the lender receives payment, they’ll process the loan closure and release the lien. This usually takes 3–10 business days.

During this time:

– The lender will send you a lien release document (sometimes called a “satisfaction of lien” or “release of lien”)

– They may also send the title directly to you or to the buyer, depending on state rules

Keep an eye on your mailbox and email. If you don’t receive the release within two weeks, follow up with the lender.

Step 5: Transfer the Title to the Buyer

Once the lien is released, you can legally transfer ownership.

Here’s how:

– Sign the title over to the buyer (follow your state’s signature requirements—some need notarization)

– Provide a bill of sale (many buyers will give you one)

– Remove your license plates (keep them or return to the DMV, depending on your state)

The buyer will then take the title and lien release to the DMV to complete the transfer.

Pro tip: Take photos of the signed title and bill of sale before handing them over. This protects you in case of disputes.

Step 6: Notify the DMV (If Required)

In some states, you’re required to notify the DMV when you sell a vehicle—even if it’s junk. This protects you from liability if the car is later involved in an accident or traffic violation.

Check your state’s DMV website for specific rules. In many cases, submitting a “notice of sale” form online or by mail is enough.

Working with Cash-for-Cars Companies: What to Look For

Visual guide about Sell Junk Car with Lien

Image source: ik.imagekit.io

Not all junk car buyers are created equal. When you’re dealing with a lien, you need a company that understands the process and won’t leave you hanging.

Here’s what to look for:

Experience with Liens

Ask upfront: “Do you buy cars with outstanding loans?” Reputable companies will say yes and explain how they handle it.

Avoid buyers who tell you to “just pay off the loan first” or “we can’t help.” That’s a red flag.

Transparent Pricing

A good buyer will give you a clear offer based on the car’s condition and current scrap metal prices. They won’t lowball you or change the offer after seeing the car.

Ask: “Is this your final offer?” If they say it depends on inspection, that’s normal—but the difference should be minimal.

Free Towing and Fast Payment

Most legitimate junk car buyers offer free towing and same-day payment. This is especially helpful if your car doesn’t run.

Make sure they schedule pickup only after you’ve accepted the offer and coordinated with your lender.

Positive Reviews and Licensing

Check Google, Yelp, and the Better Business Bureau. Look for companies with 4+ stars and real customer reviews.

Also, verify they’re licensed and insured. This protects you in case of damage during towing.

Example: “Cash for Clunkers USA” has over 500 reviews and clearly states on their website that they buy cars with liens. They even provide a step-by-step guide for customers.

Common Mistakes to Avoid When Selling a Junk Car with a Lien

Even with the best intentions, it’s easy to make mistakes when selling a junk car with a lien. Here are the most common ones—and how to avoid them.

Mistake #1: Trying to Sell Without Clearing the Lien

Some people think they can just hand over the car and let the buyer deal with the lender. Big mistake.

If the lien isn’t cleared, the buyer can’t register or scrap the car. They may back out, demand a refund, or even sue you.

Always resolve the lien before or during the sale.

Mistake #2: Not Getting a Payoff Quote

Guessing how much you owe is risky. Interest and fees can add up quickly.

Always get a 10-day payoff quote from your lender. This locks in the amount and prevents surprises.

Mistake #3: Accepting a Check Made Only to You

If the lender requires joint payment, don’t accept a check made only to you. It could be rejected, delaying the entire process.

Insist on a joint check or direct wire transfer.

Mistake #4: Forgetting to Get a Lien Release

Just because the loan is paid doesn’t mean the lien is automatically removed. You must receive a signed lien release from the lender.

Keep this document safe—it’s proof the debt is cleared.

Mistake #5: Not Keeping Records

Save everything: payoff quotes, payment receipts, signed titles, bills of sale, and communication with the lender and buyer.

These records protect you if there’s a dispute later.

What If You Owe More Than the Car Is Worth?

This is a tough spot—but not uncommon. Many people owe more on their car than it’s worth, especially older or damaged vehicles. This is called being “upside-down” on your loan.

So what do you do if your junk car is only worth $1,500, but you owe $3,000?

You have a few options:

Option 1: Pay the Difference Out of Pocket

If you can afford it, pay the remaining balance after the sale. For example:

– Car sale: $1,500

– Loan payoff: $3,000

– You pay: $1,500

This clears the debt and frees you from the loan.

Option 2: Negotiate with the Buyer

Some junk car buyers may offer a little extra if you’re close to breaking even. It’s worth asking: “Can you increase the offer by $200 to help cover the gap?”

They might say no—but it never hurts to ask.

Option 3: Trade-In or Private Sale (If Possible)

If the car still runs, consider a private sale or trade-in. You might get more than a junk car offer.

But if it’s truly junk (doesn’t start, major damage), this may not be feasible.

Option 4: Work with Your Lender

In rare cases, lenders may accept a “short sale”—where they agree to take less than the full payoff amount. This is uncommon for auto loans but possible if you’re facing financial hardship.

Contact your lender and explain your situation. They may offer a settlement or payment plan.

Legal and Financial Considerations

Selling a junk car with a lien involves more than just paperwork—it has legal and financial implications you should understand.

Liability After the Sale

Once the title is transferred and the lien is released, you’re no longer responsible for the car. But until then, you could be liable for accidents, tickets, or towing fees.

That’s why it’s crucial to:

– Complete the sale quickly

– Notify the DMV if required

– Keep proof of sale

Tax Implications

In most cases, selling a junk car isn’t a taxable event. You’re not making a profit—you’re disposing of an asset.

However, if the sale covers the loan and you receive cash, that money is not income. It’s simply reducing your debt.

Always consult a tax professional if you’re unsure.

Impact on Credit

Paying off your auto loan early (even through a sale) can actually help your credit score. It reduces your debt-to-income ratio and shows responsible financial behavior.

Just make sure the lender reports the account as “paid in full” to the credit bureaus.

Final Tips for a Smooth Sale

To wrap things up, here are a few final tips to make selling your junk car with a lien as smooth as possible:

– Start early. Don’t wait until the last minute. Lien releases take time.

– Be honest with the buyer. Disclose the lien upfront to avoid delays.

– Use a reputable buyer. Check reviews and ask for references if needed.

– Keep copies of everything. You’ll thank yourself later.

– Stay in touch with your lender. Follow up if you don’t hear back.

Selling a junk car with a lien might take a little extra effort, but it’s completely doable. With the right preparation and partners, you can turn that old clunker into cash—and finally be free of that loan.

Frequently Asked Questions

Can I sell my junk car if I still owe money on it?

Yes, you can sell a junk car with a lien, but you must first pay off the loan or coordinate payment with your lender. The sale proceeds typically go directly to the lienholder to clear the debt.

Do I need the title to sell a junk car with a lien?

You don’t need a clear title upfront, but the lien must be released before the title can be transferred. Work with your lender and buyer to ensure the lien is removed after payment.

What happens if I sell my car without clearing the lien?

Selling without clearing the lien is illegal and can result in fines, legal action, or repossession. The buyer also won’t be able to register or scrap the vehicle.

How long does it take to release a lien after payment?

Most lenders release the lien within 3–10 business days after receiving full payment. You’ll receive a lien release document by mail or email.

Can a junk car buyer pay my lender directly?

Yes, many reputable buyers will wire funds directly to your lender or send a joint check. This ensures the payment is applied correctly and speeds up the process.

What if my car is worth less than what I owe?

If you’re upside-down on your loan, you’ll need to pay the difference out of pocket or negotiate with the buyer. Some lenders may consider a short sale in rare cases.